Less than 9% of Americans1 become millionaires, and even fewer can make that money last. Economic volatility has historically triggered “richcessions,” or periods when high-net-worth individuals experience greater economic losses compared to those lower on the wealth spectrum. When the dot-com bubble wiped out $6.2 trillion in household wealth2 in 2000, for example, we saw how abruptly circumstances can shift—top earners dealt with concentrated losses. As recently as 2022, 3.5 million people3 globally, half from the U.S., lost their millionaire status in the face of turbulent financial markets and high inflation.

A rebounding stock market and stabilizing economy cannot guarantee your prosperity. Unexpected tax policy changes can diminish your finances, and personal obstacles like divorce or liability claims can wipe out much of your savings by surprise. Business owners should also exercise caution, as mismanagement or inadequate succession planning can put your assets in jeopardy.

Building wealth is only the beginning. You need a robust plan to preserve and grow your money—or prepare to watch it erode. We work directly with clients to help reduce risk and safeguard net worth through comprehensive financial planning. Our approach aims to protect your assets, enhance your wealth and achieve your financial goals. Here we’ll provide a high-level review of the key financial planning strategies to implement so that your hard-earned money remains resilient in the face of escalating challenges.

Why now?

Congress’ budget reconciliation process puts constraints on any provisions that increase the federal deficit outside a 10-year window, which includes several hallmarks of the TCJA.

Technically speaking, Congress could opt to renew all or a portion of the existing tax provisions beyond their expiration. However, because of financial concerns, there is currently little to no appetite for this. In its most recent national deficit projections, the Congressional Budget Office estimates that extending the TCJA in full would cost the nation a staggering $3.3 trillion,2 or $3.8 trillion with interest, through 2033.

The national debt and deficit, already at pronounced levels, make an additional $3 trillion financial commitment unpalatable. Political division in Washington, D.C., stifles cooperative policymaking, rendering consensus on major financial measures elusive. And a growing trend to target the “wealthy”—an ambiguously defined group that encompasses a broad income spectrum—creates an inhospitable environment for tax cut extensions.

While no one knows exactly where Congress will land on a new tax bill, the lack of interest in renewing key TCJA provisions punctuates the transience of the position we’re in at this moment. No matter how confident you are in your current tax strategy, it could soon be defunct.

Depending on your individual priorities and financial goals, the coming years could present opportunities—to pull forward income, prepare for the return of more itemized deductions, and maximize a temporary window of remarkable multigenerational wealth transfer opportunities. Otherwise, brace for considerable impact and regret in a few short years.

Let’s inspect four key tax planning opportunities to prioritize before the TCJA provisions in question expire.

1. Investment Management

at an inflation rate of 3.7%, $1 million in savings would lose half its value in roughly 20 years.

You need to put your money to work, but the financial markets offer no guarantees. Without proper oversight and strategy, you can suffer large losses in the face of market volatility or poor asset allocation. This is where investment management comes into play to provide you with deliberate selection and diversification plus ongoing supervision of your portfolio.

Since our inception in 1994, our commitment has been to identify optimal investments for our clients and help ensure strong risk-adjusted performance. We meticulously craft portfolios that reflect your risk tolerance and align with your investment preferences. Let’s look at how we reduce risks and identify opportunities for your portfolio.

- Can pay the tax bill out of pocket

- Do not need converted Roth assets for five years

- Will be in the same or higher tax bracket in retirement

- Can reduce your total tax liability at the time of conversion

Building the foundation of your portfolio

A successful investment strategy starts with a strong core. We often recommend beginning with low-cost investments that you strategically divide between stocks, bonds and cash. The balance you strike depends on your individual timeline, risk appetite, tax considerations and overarching investor mindset. You can then opt to augment your foundation with select actively managed investments or, if you are a qualified investor, alternative investments, chosen for their potential to improve your portfolio’s performance.

Managing risk with diversification

We frequently work with clients who have a concentrated equity position and lack sufficient balance in their portfolio. Without adequate diversification, one poor investment can wreck your strategy.

Consider investors who, in 2014, bought shares of Dish Network in the belief that wireless spectrum licenses would be the next big thing. By 2023, the rise of streaming had driven Dish’s stock price5 down by a staggering 93%.

When you have a large stock position, we can step in to reallocate concentrated shares if needed and spread a portfolio across domestic and international stocks, bonds and more to help mitigate risks.

One widely adopted diversification approach is the 60/40 strategy—60% stocks, 40% bonds. This allocation, which combines the growth potential of stocks with the stability of bonds, has historically earned an average annualized return of nearly 9%6 in our experience.

While the traditional 60/40 model has its merits, every investing approach varies. We still see value in bonds for their ability to cushion against market downturns. However, diversifying further by introducing alternative investments, such as private equity and real estate, can offer additional protections and upside if you are a qualified investor.

Alternative investments

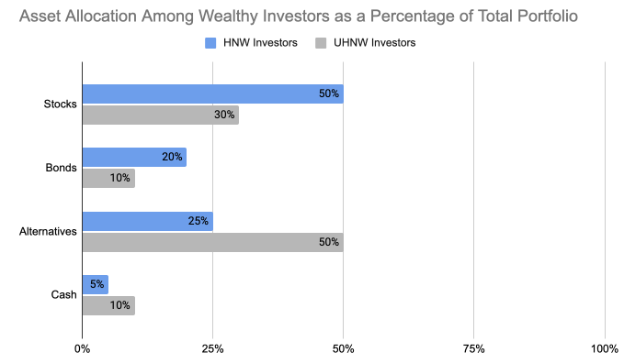

Wealthy investors allocate as much as 50% of their investments to alternatives like private equity, a stark contrast to the 5% average investors typically commit.7 Why are they putting so much into alternatives?

Source: Origininvestments.com

Alternative investments can offer you distinct advantages, including the potential for higher returns and unique diversification opportunities. With the financial flexibility to navigate the inherent illiquidity of many alternatives, you can tap into exclusive investment areas like private equity, hedge funds and direct real estate transactions. These investments often deliver returns that are independent of traditional stock and bond markets, providing an added layer of portfolio protection.

For example, over the last 10 years, private equity in real estate has seen a compounded annual growth rate of 10%,8 as highlighted in Bain & Company’s 2023 Global Private Equity Report. Meanwhile, the growing infrastructure and construction sector, which is perceived as less volatile than tangible property, experienced annual growth of 18%.

The potential for high returns is one reason we introduced private market investments to our clients. Another reason is these investments can involve entities not listed on public exchanges. Interestingly, the U.S. has over 10,000 private companies, exceeding the roughly 4,000 publicly listed companies9 and offering a vast investing universe in which you can achieve greater diversification. It’s also worth noting that companies are staying private for longer, meaning more growth is occurring outside of public markets.

In short, alternatives can offer three major advantages: Tapping into early-growth private businesses, broadening investment horizons beyond public spheres and potentially achieving better risk-adjusted returns. Please note that alternative investments are for qualified investors and involve a high degree of risk. They can be speculative and volatile. To determine whether alternatives are a fit for your portfolio, talk with your advisor.

Balancing your portfolio today

A balanced portfolio withstands the test of time by diversifying across asset classes, sectors and market caps—and history has shown how important this is. In the early 1970s, the Nifty Fifty of large blue-chip stocks such as Coca-Cola and Polaroid10 drove gains before a 1973–74 stock market crash cut the Dow Jones by nearly half11 and ruined fortunes. In the late 1990s, tech stocks powered major advances before the dot-com bubble burst. More recently, FAANG stocks fueled bull markets pre-2020 before succumbing to drawdowns. These examples illustrate why we never concentrate a portfolio in just a handful of recent winners. As history shows, it’s extremely risky.

For those apprehensive of stock market concentration, bonds are an appealing alternative. While stocks undeniably carry more risk than cash, bonds serve as a middle ground, providing growth and a cushion against stock market uncertainties.

Finally, if you are a qualified investor, diversifying into alternatives such as real estate, private equity and commodities can offer avenues to reduce concentration risk. These assets not only have the potential for significant returns but also bring uncorrelated performance relative to traditional stock and bond markets. By incorporating a blend of these alternatives, you may further optimize your portfolio for both growth and resilience.

Remember that every approach to investing should be personal. Whether you lean toward active or passive strategies, have a passion for socially conscious investing or a certain industry, we can create a portfolio that resonates with your investing philosophy.

2. Tax Efficiency and Mitigation

Wealth creation and preservation extend beyond making the right investments. An efficient tax strategy is indispensable to protect more of your wealth from the IRS. Here, we cover specific tax reduction strategies that take developing tax policies into consideration.

Accelerating income in low-tax years

Key provisions of the Tax Cuts and Jobs Act (TCJA) will expire in 2025, and we expect the top marginal tax rate to return to 39.6%, up from the current 37%.

This top rate will probably reach more taxpayers, and brackets such as 28% and 33% could also return. Generally, all marginal tax rates will probably move higher except the 10% bracket, so we recommend looking for opportunities to pull forward income over the next two years to take advantage of today’s lower tax rates.

Tactics to consider include selling appreciated assets now or requesting bonuses or dividends in the current tax year. For those with businesses, look at managing your income, deductions and distributions. You want to structure things so that you recognize more income before the pass-through business tax break possibly disappears.

Roth conversions

A Roth conversion involves transferring assets from a traditional IRA to a Roth IRA. While this requires you to pay taxes on the converted amount, the subsequent growth and eventual withdrawals from the Roth IRA are tax-free. This strategy can be beneficial if you expect to be in a higher tax bracket in the future.

When thinking about a Roth conversion, consider the strategy of “topping up to bracket.” First, you determine your income and corresponding tax bracket. Then you convert an amount from your traditional retirement plan that will fill up the remaining portion of your current bracket without going over into a higher bracket. This is typically more beneficial for people in lower brackets (such as 12%), but it can be suitable for higher brackets like 24% as well.

Backdoor and mega backdoor Roths

If your income exceeds the limit to contribute directly to a Roth IRA without facing a penalty, there are backdoor and mega backdoor Roth strategies. A backdoor Roth involves contributing post-tax money to a traditional IRA and then converting it to a Roth IRA. A mega backdoor Roth allows you to contribute after-tax money to an employer-sponsored plan and then roll those funds over to a Roth IRA. For 2023, you can contribute up to $66,000 to the mega backdoor Roth, or $73,500 if you’re 50 or older.12 This is the IRS’s upper limit for all contribution types.

Consider this example: Jane is under the age of 50. She maxes out her 401(k) contribution and receives an employer-matching contribution. Her $22,500 individual contribution plus a $2,000 employer match totals $24,500. Subtract this amount from the $66,000 maximum limit, and Jane has up to $41,500. She could add this to her 401(k) and roll into a Roth IRA with the mega backdoor option.

Here’s when a mega backdoor Roth IRA may be right for you:

- Your company allows both after-tax contributions to and in-service withdrawals from a Roth IRA.

- You already maxed out your 401(k) and IRA contributions.

- You have excess savings after meeting monthly expenses such as your emergency fund, higher education costs and other debt obligations.

Charitable contributions

Charitable giving can serve a dual purpose: You support meaningful causes while benefiting from tax deductions. For this year, donations made to qualifying charities can be deducted up to 60%13 of your AGI. (We expect this threshold to revert to 50% when the TCJA expires.) A typical target is about 30% of AGI. This is the limitation on long-term capital property, which is a common type of gift.

Let’s look at two popular trust structures for charitable giving.

Charitable remainder trust (CRT): With a CRT, you can donate assets to the trust, which then provides you or other named beneficiaries an income for a set term. Once the term ends, the remaining assets go to the charity. This provides an immediate charitable deduction and can offer potential estate tax benefits. The CRT structure can be more beneficial in high-interest-rate environments because the immediate charitable deduction is larger.

Donor-advised fund (DAF): By contributing to a DAF, you secure an immediate tax deduction. From there, you can recommend grants from the fund to your chosen charities over time, allowing the money to potentially grow tax-free.

3. Estate and Succession Planning

Estate and succession planning are essential components of your financial strategy, guiding the management and transfer of assets to preserve your legacy.

With the IRS continually ramping up its examination efforts, it’s critical that your estate plan be meticulously constructed and regularly reviewed.

Essential documents and trusts

To strategically develop an estate plan, begin with drafting the core documents: Wills, powers of attorney and health care directives. These lay the groundwork for your wishes and decision-making. Next, consider establishing diverse trusts tailored to specific needs and goals. As laws and your personal situation change, it’s crucial to revisit and update these documents so that they remain compliant and reflective of your current objectives.

Reducing estate taxes

Estate taxes, which can range from 18% to 40%, have the potential to deplete your wealth and reduce the amount you can leave to future generations.

The expiration of the TCJA estate tax provision will probably reduce the exemption from over $13 million in 2024 to between $6 million and $7 million per individual.

Strategic gifting paired with the creation of trusts can give you flexibility and control while maximizing current exemptions. Irrevocable life insurance trusts (ILITs) and spousal lifetime access trusts (SLATs) are popular choices for this kind of scenario.

Philanthropy

If you’re focused on immediate family inheritance and wealth preservation, you may underestimate the significance of incorporating charitable giving into your estate plan. But charitable giving offers substantial tax advantages and the potential for a lasting impact.

Strategic gifting can help ensure that your legacy stretches for generations. These contributions might reduce the taxable value of your estate, leading to a lighter tax burden on your heirs and enabling more of your assets to be directed toward philanthropic endeavors that matter to you.

4. Insurance and Risk Management

Having built substantial wealth, you want to protect your assets from unforeseen risks. Real estate, bank accounts, personal property and even your future earning potential can be vulnerable, especially in the event of a lawsuit. If you own a business, the stakes are even higher because both personal and business assets could be at risk, depending on your business structure and location.

To effectively shield your wealth, consider these insurance options and risk management strategies.

Property insurance

It’s essential to obtain appropriate homeowners insurance, especially when you have significant assets. Here’s a look at important coverage types.

Specialized coverage for high-value homes: Luxury homes, given their unique features and materials, can be pricey to reconstruct. Insurance providers sometimes offer dedicated policies for residences that would cost $750,000 or more to rebuild. While a standard policy might cover a high-value property, optional coverages like extended replacement cost ensure that after a significant loss or catastrophe, there’s enough protection for the entire rebuilding process.

Replacement cost for belongings: Standard policies often cover items at their current market value, which considers depreciation. Replacement cost coverage, however, ensures that damaged items from covered incidents are replaced without depreciation deductions. This option might come with a higher premium, but it’s a good choice for personal property.

Enhanced liability: Homeowners insurance includes protection if you’re deemed responsible for damages or injuries to another party. But if your net worth surpasses the maximum liability coverage limit in standard policies, an umbrella policy is an excellent choice. This policy offers added protection, often up to an extra $5 million,14 securing your assets comprehensively.

Auto insurance

When insuring high-value or luxury vehicles, consider the steps below to customize your auto insurance.

Review your deductible: Start by opting for the highest deductible that aligns with your financial comfort level. This strategy can reduce your insurance premiums while providing adequate coverage. Concentrate your insurance budget on the coverages you truly require, such as liability, personal injury protection, medical payments coverage and uninsured/underinsured motorist coverage.

Obtain specialized coverage: Luxury, high-performance, exotic or collector cars require specialized insurance. These vehicles appreciate in value or maintain their worth, unlike standard cars, which depreciate. You should opt for an “agreed value” policy, which accounts for the unique value trajectory of your vehicle.

Prioritize policies that guarantee the use of original manufacturer parts for repairs, not subpar alternatives.

Add rental car replacement: Include a rental car replacement provision in your policy. With this in place, you won’t get an inappropriate substitute vehicle while yours is undergoing repairs.

Umbrella insurance

Umbrella insurance is an extra layer of liability protection that goes beyond the coverage limits of your primary insurance policies. We mentioned an umbrella policy in the context of your property insurance, but it can also supplement your personal and auto insurance policies.

Liability risks loom larger when you have substantial wealth that encompasses luxurious homes, high-end vehicles, art collections and more. Any incidents involving these assets can lead to significant liability claims. Active involvement in social, charity and business spheres can expose you to a broader range of people and potential liability situations.

Managing large estates and employing household staff can introduce liability risks tied to accidents, injuries or employment disputes. Umbrella insurance offers several key advantages, such as significantly increased coverage limits and greater protections to cover personal injury, property damage, libel, slander and defamation. Additionally, it can cover the costs associated with legal defense.

On average, umbrella insurance is relatively affordable; you can expect to pay between $375 to $525 per year for $5 million in coverage,15

which is often advisable if you have a larger net worth. If you own multiple homes, high-end vehicles, boats and other property, you’ll likely need a custom liability policy with a more specialized approach to insurance.

Life insurance

You can tailor life insurance to your financial situation and objectives. Here are some key considerations and benefits.

Mitigating estate taxes: Life insurance, when paired with trusts, can help mitigate estate taxes. When you place a life insurance policy inside an ILIT, the death benefit is outside of your estate. Once you pass away, the benefit goes to the trust. This prevents the death benefit from being counted as part of your taxable estate. Beneficiaries can use funds in the trust to pay any estate taxes due, transferring more of your wealth directly to your loved ones, not the IRS.

Safeguarding asset value: It can be financially straining when a business or property decreases significantly in value. However, a life insurance policy can offer a solution: Upon the policyholder’s death, the life insurance provides a tax-free payout (the death benefit), and this amount can offset the financial losses from the devalued business or property.

Business stability: For businesses with multiple partners, life insurance can offer additional protections. Upon the untimely death of a key partner, the insurance can serve as a funding source for buy-sell agreements. This approach keeps the business’s assets intact, eliminating the need to liquidate them to purchase a partner’s share.

Disability insurance

This type of insurance provides income in the event you cannot perform your work because of disability. These policies may be expensive to purchase on your own, but they can be precious in certain circumstances. For example, if you own your own business, you can’t count on an employer to provide you with disability insurance—it’s your responsibility. This coverage can ensure you’ll still have income if your ability to run your business is seriously impeded by disability.

5. Advanced Planning

Business owners and high-earning employees need strategies to handle their money, mitigate taxes and prepare for the future. Here are some top areas of consideration.

Equity compensation

For individuals with substantial assets, optimizing equity compensation is essential for growing and diversifying wealth—the right strategies can maximize value while mitigating tax implications. Key factors include the vesting schedule, potential capital gains taxes and the overall integration of equity compensation in your financial portfolio.

For example, imagine you’re an early employee at a tech startup and you receive stock options at a strike price of $10. Over time, the company excels, and the share price rises to $50. By exercising your options, you buy shares at $10 and can sell them for $50, gaining a $40 profit per share. Instead of selling immediately (and being taxed at higher short-term capital gains rates), you hold the shares for over a year. By doing so, you qualify for the lower long-term capital gains tax rate, maximizing your net profit.

For business owners, offering equity compensation is a strategic way to attract and retain talent without immediate cash expenses. This approach aligns employees’ interests with the company’s success by making them stakeholders. (However, this also dilutes the current ownership.) Vesting schedules can encourage long-term commitment by letting employees earn their equity over time. Companies offering equity as compensation can often deduct it as a business expense, reducing their book income.16 But keep in mind that stock-based compensation generally can’t be deducted from taxable income until employees vest their shares or exercise their stock options.

Business ownership structures

It’s important to structure practice ownership and profit-sharing to align with your financial goals and risk tolerance. An efficient structure can provide tax advantages, limit liabilities and enhance profitability.

Sole proprietorships and LLCs often face pass-through taxation, meaning profits are taxed at the owner’s personal rate. S-corporations also have pass-through taxation, but they can avoid self-employment taxes on a portion of the income. C-corporations are taxed at the corporate level, potentially facing double taxation when profits are distributed as dividends. Besides these considerations, ease of setup and management factor into structure selection.

It’s important to understand that LLCs do not help you save money on taxes. You can elect to classify your LLC as an S-corporation to save on self-employment taxes, but talk with your tax preparer or accountant before making this election.

Tax-advantaged retirement plans

Consider plans like SEP IRAs or solo 401(k)s to defer taxes and bolster savings. These retirement plans are designed for the self-employed and small business owners, and they allow for significant tax-deferred contributions. By allocating funds to these accounts, business owners can decrease their present taxable income, lowering immediate tax liabilities. Simultaneously, they bolster their retirement savings, which will grow tax-free until withdrawal.

Exit planning

An effective exit strategy considers the desired timeline, business valuation, and potential successors or buyers. The sale’s timing can affect taxes: Selling in a lower-income year might decrease tax liabilities. Tax implications can also vary based on the assets sold. For example, tangible assets like equipment can differ from intangible assets such as goodwill. Choosing between an asset sale and a stock/share sale can further influence the tax outcome. Some business owners might gift shares progressively to benefit from gift tax exclusions, or they might favor a gradual buy-in, which can mitigate tax burdens and facilitate a smoother transition.

To Preserve Your Wealth, Craft a Detailed Financial Plan

Managing your wealth demands careful planning and timely action. External and personal risks abound, threatening the life you worked tirelessly to build. While inflation eats into your savings, a concentrated stock position or emotional decisions can jeopardize your market portfolio. We are here to assist in all aspects of your financial plan. We offer comprehensive investment management, constructing a diversified portfolio that weathers market fluctuations. Our team will guide you on potential tax implications and help you prioritize insurance for protection against unexpected liabilities. For business owners, we can advise on selecting the most suitable structure and help create a clear transition plan for sustainability. Call now and let’s collaborate to safeguard and grow your assets for years to come.

Sources:

1 McCain, A. (2023, February 24). 33 incredible millionaire statistics [2023]: 8.8% of US adults are millionaires. Zippia.

2 Sufi, A., & Mian, A. (2014, May 12). Why the housing bubble tanked the economy and the tech bubble didn’t. FiveThirtyEight.

3 Taylor, C. (2023, August 17). ‘Richcession’ hits as 3.5 million millionaires lost their status last year—while the average person saw wealth spike. Yahoo.

4 Iacurci, G. (2022, June 10). Do you want to know how inflation impacts your savings? The ‘rule of 72’ may help. CNBC.

5 Olakoyenikan, S. (2023, June 21). The best and worst performing stocks so far in 2023. Forbes.

6 Adviser Investments. (2020, August 19). The enduring upside of the 60/40 approach.

7 Spitz, J. (2023, May 9). How the wealthy invest: A shift to private equity and real estate. Origin Investments.

8 Bain & Company. (2023). Global private equity report.

9 Spitz, W. (2023, July 19). The dominance of private equity. Diversified Trust.

10 Heaven, P. (2022, November 14). Posthaste: Remember the fall of the Nifty Fifty? Hope so because we may be reliving it. Yahoo.

11 Shadow of ’70s bear looms, but was it really as bad as we think? (1996, November 3). Los Angeles Times.

12 Long, K. (2023, May 9). How the mega-backdoor Roth works. Journal of Accountancy.

13 Internal Revenue Service. Publication 526 (2022), charitable contributions.

14 Mitch Insurance Brokers. (2020, January 30). Need an umbrella? Why you may want $5 million liability coverage.

15 Butler, L. (2023, July 25). How much does a $5 million umbrella policy cost? WalletHub.

16 Watson, G. (2021, October 25). Proposed minimum tax on book income would hit stock-based compensation. Tax Foundation.

Disclosures:

This material is distributed for informational purposes only. The investment ideas and opinions contained herein should not be viewed as recommendations or personal investment advice or considered an offer to buy or sell specific securities. Data and statistics contained in this report are obtained from what we believe to be reliable sources; however, their accuracy, completeness or reliability cannot be guaranteed.

All investments carry risk of loss. Past performance is not an indication of future returns. Tax, legal and insurance information contained herein is general in nature, is provided for informational purposes only, and should not be construed as legal or tax advice, or as advice on whether to buy or surrender any insurance products. Personalized tax advice and tax return preparation is available through a separate, written engagement agreement with our wholly owned subsidiary, RWA Tax Solutions, LLC. We do not provide legal advice, nor sell insurance products. Legal services are available via a separate, written engagement agreement through our exclusive relationship with Hall & Diana LLC.

Always consult a licensed attorney, tax professional, or licensed insurance professional regarding your specific legal or tax situation, or insurance needs.

Companies mentioned in this article are not necessarily held in client portfolios and our references to them should not be viewed as a recommendation to buy, sell or hold any of them.

Alternative investments are intended for qualified investors only, are speculative and involve a high degree of risk. An investor could lose all or a substantial amount of their investment. There is generally no secondary market, nor is one expected to develop, and there may be restrictions on transferring fund investments. Alternative investments may be leveraged, and performance may be volatile. Alternative investments may have high fees and expenses that reduce returns and are generally subject to less regulation than securities traded in public markets. The information provided does not constitute an offer to purchase any security or investment or any other advice. Before you invest in alternative investments, you should consider your overall financial situation, how much money you have to invest, your need for liquidity, and your tolerance for risk.