If you own a standalone long-term care (LTC) insurance policy, you may have received troubling notices from your provider flagging drastic premium increases in the coming years—to the tune of 100% to 200%—unless you reduce your benefits. After purchasing a policy many years ago, diligently paying your premiums and building plans around a certain amount of coverage, this news can feel like a bait-and-switch. And you might be anxiously wondering whether to change your policy or face much higher costs.

We caution clients against taking any immediate settlement offers or opting to reduce benefits before reviewing your policy with your advisor and, when appropriate, talking with your family.

“You bought this policy for a reason,” says RWA Wealth Partners advisor and CERTIFIED FINANCIAL PLANNER™ professional Dina Milne. “Don’t give up on it just because you’re getting a letter like this. Put it into perspective. Think about it. Is it important for you to have this coverage? And why did you get it in the first place?”

Most insurers have stopped selling these types of policies, and the costs to purchase one today are typically too expensive to justify.1 Your best option may be to keep your coverage as is—but we won’t know until we look.

Whatever you decide, it will have implications not just for your LTC plans but also for your entire financial strategy, including investing, estate planning and tax management—not to mention the goals for your legacy.

At RWA Wealth Partners, we have LTC insurance specialists on staff and advisors who are well educated on this developing situation and ready to help you navigate it. We’ll share our expert advice, helping you to interpret the policy provider notice and decide which options work best for your situation. Then you and your advisor will work closely to forge a path forward.

Personal tax rates are probably going in one direction: Up.

What’s happening with LTC insurance?

As distressing as it can be to receive a notice from your LTC insurance provider about possible—and substantial—premium increases, you’re not alone. Because of widespread industry mispricing of these policies decades ago, this is a sweeping issue affecting nearly all longtime policyholders.

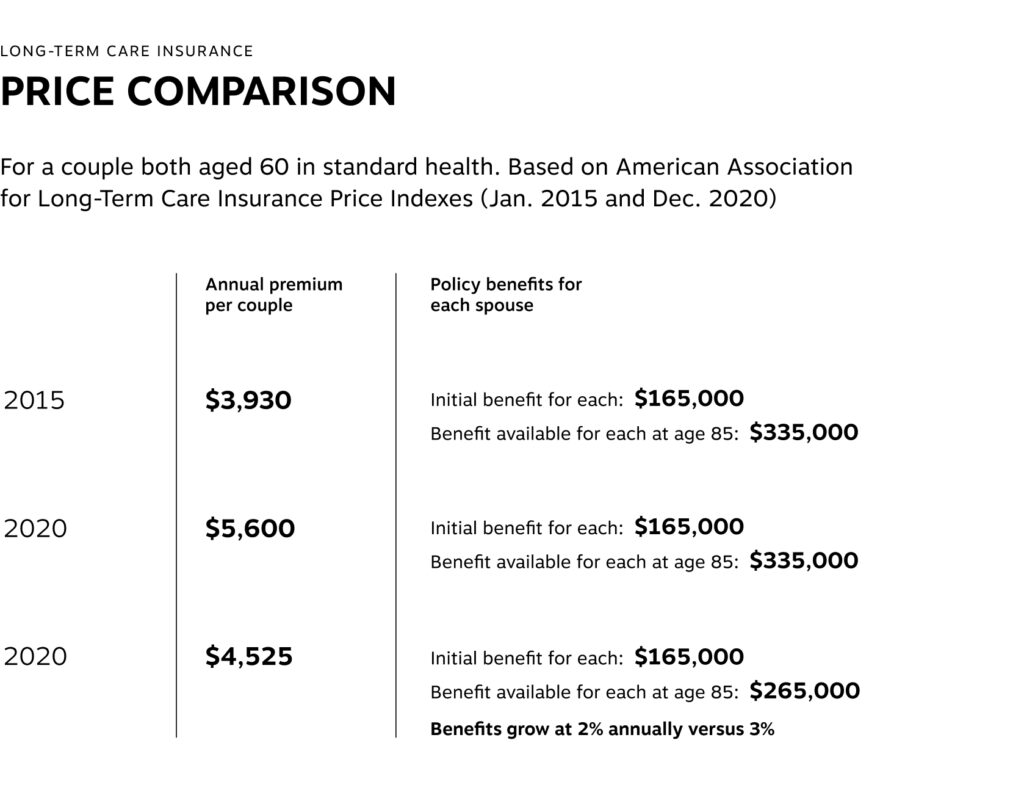

Industry data from Long Term Care Group (LTCG), for instance, describes over 3,500 approved rate increases nationwide for a cross section of LTC policies reviewed in 2021.2 The average approved rate increase over the lifetime of a policy averages 112% nationwide,3 LTCG found. Data from the American Association of Long-Term Care Insurance shows that the average annual premium per couple increased from $3,930 to $5,600 from 2015 to 20204 for the same policy benefits.

Source: American Association for Long-Term Care Insurance.

As Milne shares, “Last year, many clients called after receiving letters that their LTC premiums would increase significantly unless they substantially reduced their coverage. While unnerving, most companies provided a good amount, or around five, options to consider.”

It’s a situation that continues to escalate. She continues, “Now we’re advising some of those same policyholders who received follow-up letters conveying the possibility of even larger rate hikes and only three very poor options. They are now 15 or 17 years older than when they got the policy. So if they were to leave that company and go to another company to look for an alternative solution, their premiums would be significantly higher.”

The rising costs of LTC make the risk of reduced coverage (or no coverage) even more concerning. According to the American Action Forum, it’s expected that nursing home care will increase an average of 2.8% per year for a cumulative increase of 36.4% by 2030, while assisted living costs will increase 49.6% and home health aide costs will increase 20%.5

What’s causing a rise in LTC premiums?

The acceleration in LTC insurance premium hikes largely stems from inaccuracies in insurers’ past pricing models and projections.

Current estimates show that around 14 million people in the United States currently need LTC services and support.6 (LTC refers specifically to assistance with basic activities of daily living—or ADLs—like eating, bathing, getting dressed, toileting, moving between places and managing incontinence.)7

The Department of Health and Human Services predicts that 7 out of every 10 people who reach age 65 can now expect to need LTC at some point. As the population continues to age, estimates suggest the number of Americans needing LTC could balloon to 24 million by 2030.8 In short, people are using their policies and living much longer than expected.

The policies were mispriced in terms of longevity—people are living longer. But they were also based on the same assumptions used for life insurance, where policies often lapse. (In other words, people drop their coverage voluntarily.) With LTC policies, no one is letting their coverage lapse. So companies need to increase premiums to pay out these policies.

As Milne notes, “We’re seeing it with almost every policy someone has. Clients are being told it’s going to increase by X percent every year until this will be your new premium.”

What settlement options are insurance providers offering?

As insurers seek to adjust costs and coverage to address flawed initial pricing assumptions, many longtime policyholders are receiving letters detailing settlement proposals to reduce or change benefits.

The alternatives presented typically involve some combination of the following:

Cash payouts: Some settlements provide a limited upfront cash payment to policyholders in exchange for adjusted coverage terms intended to lower insurer costs. Proposals may couple modest cash amounts with reduced paid-up policies.

Lower daily benefits: Insurers may give you the choice to scale back daily benefit levels to reduce ongoing premium costs. Daily payout maximums could be cut severely under certain proposals.

Shortened benefit period: Similar to lowering daily amounts, companies may present options to shorten the maximum duration of payout coverage under a policy, such as from three years to one year.

Reduction or elimination of inflation rider: Companies may offer policyholders the choice to cut back or remove a rider that increases maximum benefits or daily amounts over time. This lowers the insurer’s long-term costs but reduces the future purchasing power of benefits.

Continued coverage at higher premiums: Policyholders generally have the option of retaining their current level of benefits if they will accept significantly higher (often incremental) premium costs. Projected increases range from 150% to over 250% cumulatively based on approved insurer rate-hike plans.

The exact settlement options you receive will depend on your insurance provider. You’ll likely be offered a mix of the elements above, such as inflation rider elimination plus a cash payment, or a lower paid-up benefit plus a cash payment. It can be a lot to consider, and what initially seems like the right choice may or may not be as attractive in the future.

For instance, if you lose your inflation benefit of 5%, your total lifetime benefit drops dramatically. You might find that the remaining coverage is not enough to cover nursing home care for even a year.

How a wealth advisor can help

We encourage you to reach out to your financial advisor before making any decisions about your LTC insurance policy.

At RWA Wealth Partners, we will:

1. Read your policy and clarify the notice you received from your provider

Together, we’ll go over the notice from your insurance carrier and examine your current policy to fully understand its coverage. Our experience with similar situations means we’re well equipped to guide you. We’ve helped others navigate their policies and are familiar with the challenges you’re facing. It’s common to skim through these notices and it may be tempting to jump to conclusions, but we’ll take the time to review every detail, overlooking nothing and avoiding any hasty decisions. We understand these notices can sometimes be complex. We’re here to break down the information clearly, ensuring you have a full understanding of what it means for you.

2. Look at the options the insurance carrier is giving you

We’ll carefully review the options your carrier is offering you. We’ll discuss the pros and cons of each one and ask questions such as whether a paid-up option would be anywhere close to sufficient should the need for LTC arise. We’ll walk you through how to think about inflation benefits and what it would mean to keep your current coverage. As Milne highlights, “We often find that the new options insurers are presenting aren’t the best deal for many of our clients.”

She further explains, “These paid-up options I usually would not recommend. They may involve taking away your inflation benefit and cutting your daily benefit amount significantly, maybe to $200 instead of $400.”

While these options might offer short-term savings, they don’t always stack up well for the long term. We’ll consider whether the potential premium increases are manageable for you and talk about why you got an LTC policy in the first place.

For some, a slight reduction in coverage might make financial sense. Milne notes this has been successful for some clients who chose a smaller policy to reduce premiums while still covering potential needs. “We had run the scenario and felt that it was enough to cover them,” she says.

Most times, keeping your current coverage is likely the best choice. However, as Milne acknowledges, “It’s client-specific, especially if a client has cash flow issues and can’t afford to continue to pay the premium. Now, we need to look at other options.” But she adds, “Most of the time, people can afford it, and their current benefits are the best they’re going to get. Continuing to pay the premium is, from my perspective, the best route for many people.”

3. Consider your personal situation and financial plan

We incorporate scenario planning into our discussions about your LTC insurance options to add a crucial layer of clarity and insight to the decision-making process. Our planning program can illustrate various future scenarios, such as requiring home care, staying in an assisted living facility or needing more intensive health care services.

“We’ll build out a scenario for your later years that shows either home care or being in an assisted living facility or some kind of health care facility, and we will show the costs of that,” Milne explains. “So if someone already has long-term care insurance, we will show how the long-term care will actually help fund a certain amount of years of that expense. If you don’t have the insurance, then you can see it draws down the portfolio assets and cash flow.”

This approach allows you to see how your LTC coverage—or lack thereof—will affect your financial situation. You can then determine whether the savings on premiums now would outweigh what you may have to spend on LTC in the future.

4. Review implications for your financial plan

Decisions about your LTC coverage aren’t isolated; they will have ripple effects throughout your wealth management strategy. LTC coverage can pay for a significant portion of pricey care costs, potentially reducing the amount you need to withdraw from your investment portfolios down the line. According to Care.com, the median annual cost of 24/7 nursing home care is $94,900, while the cost of a full-time home health aide is $235,872 per year.9

Without coverage, you may rely on savings and assets like IRAs to fund care, generating more taxable income. As Milne explains, “If most of your money is in retirement accounts like IRAs, that is all taxable income. So if your expenses for the year are $180,000, you are generating $180,000 worth of income that needs to come out of that IRA.”

The decision also influences investment strategy. If you expect substantial portfolio withdrawals to cover care costs, you may need to take a more conservative approach to provide greater stability when those withdrawals occur. If you’re not relying on large withdrawals to cover health care expenses, it gives you more flexibility in how you can invest.

5. Recommend what is best for you

Ultimately, your advisor can make a recommendation for how to proceed with your LTC insurance policy. Milne highlights the importance of understanding your priorities: “If it’s important to leave money to the kids, you don’t want to draw it down if you have a medical event that goes on for years.”

She adds perspective on the broader impact of LTC planning: “It’s not just about your assets. It’s about your family and your caregivers.” The emotional and practical aspects of LTC—like the strain it can put on family members who may need to adjust their lives to provide care—are often overlooked. “How will that affect them?” Milne asks.

Think of LTC as touching all critical points of financial planning: Protecting your legacy, providing sufficient cash flow and ensuring that a potentially major cost later in life doesn’t wipe out your wealth. As Milne concludes, “This is probably an insurance that you wish you never need—but it’s good to have.”

Sources:

- Rau, J. & Aleccia, J. (2024, January 2). Why long-term care insurance falls short for so many. Oregon Capital Chronicle.

- NAIC. (2021, August 3). NAIC National Meeting Summer 2021 [meeting notes]. Long-Term Care Insurance (EX) Task Force.

- NAIC. (2021, August 3). NAIC National Meeting Summer 2021 [meeting notes]. Long-Term Care Insurance (EX) Task Force.

- American Association for Long-Term Care Insurance. (n.d.). Long-term care insurance facts – Data – Statistics – 2020 reports.

- O’Neill Hayes, T. & Kurtovic, S. (2020, February 18). The ballooning costs of long-term care. American Action Forum.

- O’Neill Hayes, T. & Kurtovic, S. (2020, February 18). The ballooning costs of long-term care. American Action Forum.

- Administration for Community Living. (n.d.). What is long-term care? LongTermCare.gov.

- O’Neill Hayes, T. & Kurtovic, S. (2020, February 18). The ballooning costs of long-term care. American Action Forum.

- Bondy, H. (2022, August 26). Cost of home care vs. nursing homes: What you need to know. Care.com.

Disclosures:

For informational purposes only. Our statements and opinions are subject to change without notice. Data and statistics that may be contained in this report are obtained from what we believe to be reliable sources; however, their accuracy, completeness or reliability cannot be guaranteed.

All investments carry risk of loss and there is no guarantee that investment objectives will be achieved. Past performance is not an indication of future returns. Tax, legal and insurance information contained herein is general in nature, is provided for informational purposes only, and should not be construed as legal or tax advice, or as advice on whether to buy or surrender any insurance products. Personalized tax advice and tax return preparation is available through a separate, written engagement agreement with our wholly owned subsidiary, RWA Tax Solutions, LLC. Legal services may be obtained via a separate, written engagement through our relationship with Hall & Diana, LLC. We do not provide legal advice, nor sell insurance products. Always consult a licensed attorney, tax professional, or licensed insurance professional regarding your specific legal or tax situation, or insurance needs.

Our statements and opinions are subject to change without notice.

RWA Wealth Partners logo is a registered trademark of RWA Wealth Partners, LLC

© 2024 RWA Wealth Partners, LLC. All Rights Reserved