After the tech bubble burst and markets bottomed on October 9, 2002, the U.S. stock market recovered over the next five years with a 121% gain. While that may sound enviable, foreign stocks doubled the U.S. market over the same stretch, generating a 237% return.

Back then, it was almost heresy to suggest that investing overseas was a loser’s game. But today, after a decade-plus of dominance for U.S. stocks over their foreign counterparts, investors seem to have forgotten the vagaries of global investing—that market leadership changes, and a smart, diversified investor allocates holdings to stocks both home and abroad to not miss out when the tide turns.

That’s why we’ve always felt it is important to have some foreign stock market exposure in client portfolios. We have good reason to think there are great opportunities for investors willing to venture beyond our shores today.

In this special report, available exclusively from Adviser Investments, you’ll learn why investing in foreign companies might make sense for you. Among the factors:

- The large number of foreign companies nearly doubles the investable universe over a U.S-only strategy

- Foreign investors are paying far less for every dollar of earnings

- Foreign markets may present greater upside opportunity at this stage of their economic and market recoveries

A World of Investments

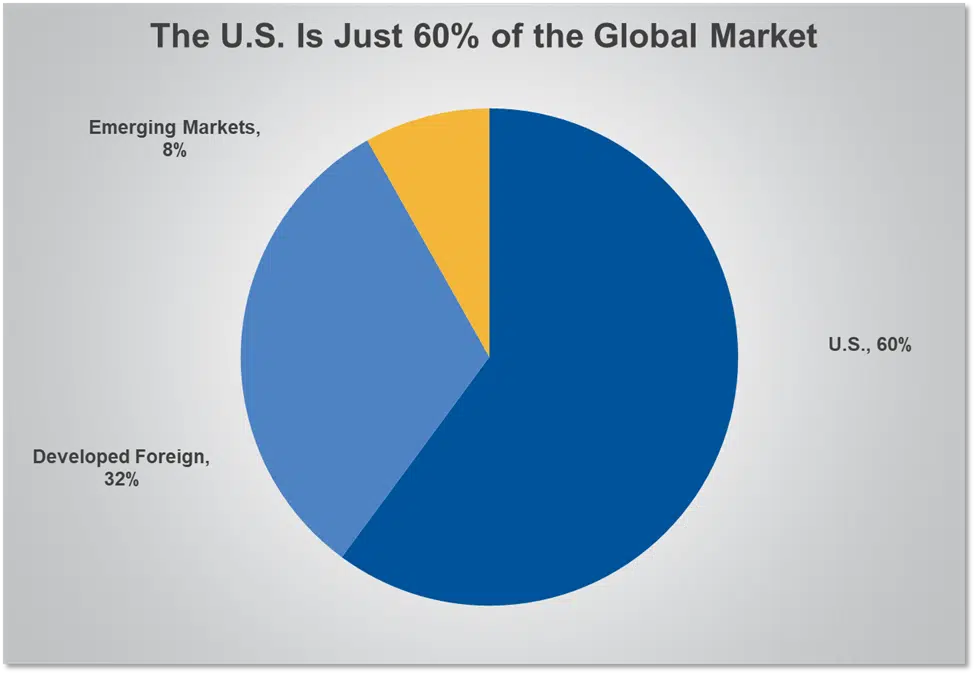

The U.S. doesn’t have a monopoly on good businesses, entrepreneurial spirit and profit potential. In fact, there are many more companies located outside of the U.S. than within. Consider that Vanguard’s Total Stock Market Index fund, which includes stocks of all shapes and sizes in the U.S., has approximately 3,900 companies in its portfolio. Meanwhile, Vanguard’s broadest foreign stock index fund, Total International Stock Index, holds shares in nearly 8,000 companies. As you can see in the chart below, U.S. stocks only account for just 60% of the global market.

More stocks to choose among doesn’t necessarily mean better results, but it does offer a tremendous opportunity for investors. International stock markets allow you to easily and affordably boost diversification and reduce risk in a portfolio.

Investors have several options when investing outside our borders. “Global” funds, as the name implies, have a worldwide mandate and invest in both U.S. and foreign companies. “International” funds invest in companies based in countries outside of the U.S. Chances are you use the goods or services of one or more of these non-U.S. companies: Honda (Japan), Nestlé (Switzerland), Bayer (Germany) and Samsung (South Korea)— all are names that you won’t find as components of a “U.S.- only” portfolio or index.

The countries that make up the international markets are divided into one of two categories, either “developed” or “emerging.” Developed countries tend to have stable political systems, mature economies, high levels of income, established rules of law and transparent regulations governing their financial systems and investment markets. Examples of developed foreign markets are Germany, the United Kingdom, Japan and Australia.

Emerging countries typically are in earlier stages of economic and/or political development. As a result, their markets tend to be less stable and more susceptible to missteps. They also tend to be faster growing. Examples of emerging economies include China, much of Southeast Asia, Eastern Europe and Latin America.

And younger and more fragile markets, such as those in Ukraine, Vietnam and much of Africa, are categorized as “frontier” markets; members of this group are in even earlier stages of economic, political and market development. Frontier markets represent a very small foothill on the global landscape.

Now that you’ve had our crash course on foreign markets, here’s why should you consider investing in them.

A Passport for Your Portfolio

“Don’t put all of your eggs in one basket.” We’ve all heard the saying before, and it applies to investing as much as it does to life. In investing parlance, it’s called “diversification.” Owning assets that don’t all react to the same consumer, business or economic trends makes your portfolio more resilient: If one investment performs poorly, you have others that may pick up the slack. We believe that diversification is an essential form of risk control in any portfolio.

Diversification comes in different flavors. You can diversify the types of assets you hold—stocks, bonds, cash, real estate, commodities, alternatives, etc. You can also diversify by owning multiple stocks. And in this report, we are talking about diversifying by investing in stocks of companies based in multiple countries.

If all your investments are in just one country, and that country’s economy or market goes through a major decline, well, your portfolio will likely suffer the full consequences. If you’d put all your eggs in Japan’s basket in the late 1980s, you’d be able to make fewer omelets today than when you started out over three decades ago. By the same token, an investment in U.S. markets in the early part of the 21st century significantly underperformed investments in non-U.S. markets for years.

Now, to be clear, we are not predicting that U.S. stocks will fall or foreign markets are poised to outperform. Actually, we remain constructively bullish on America and the strengths of its companies and marketplace. But investing exclusively in the U.S. stock market means your portfolio is wed primarily to the fortunes of just one country. If the U.S. stumbles, for whatever reason, so will your portfolio.

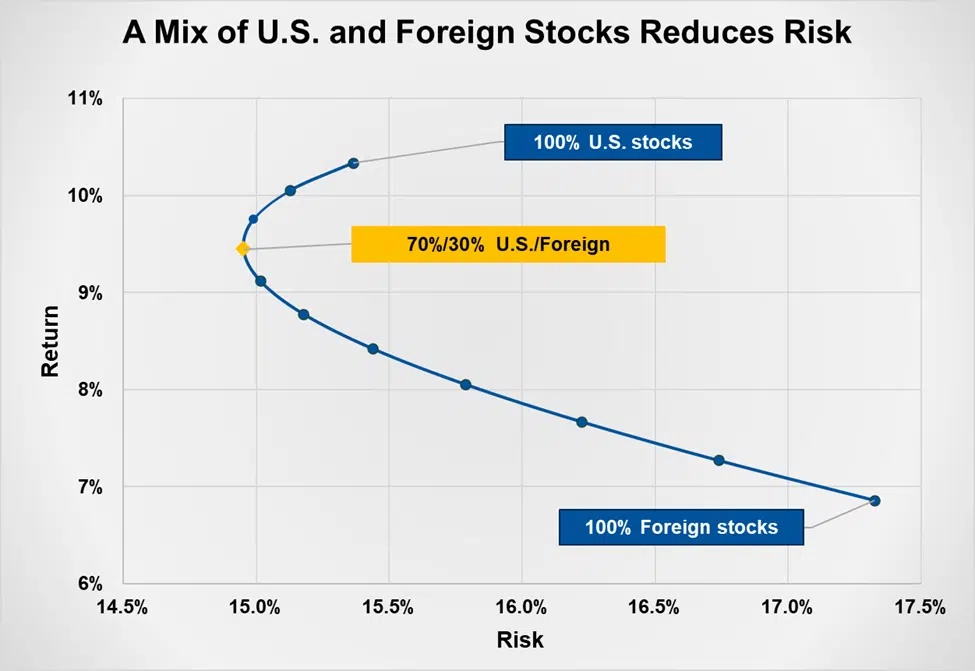

Given the fact that U.S. markets have been global leaders for the last decade-plus, it pays to take a broad, longer-term view. Our “efficient horizon” chart above measures the risks and returns of portfolios with varying allocations to U.S. and non-U.S. stocks. It clearly shows that adding an allocation to foreign companies in a stock-only portfolio has helped to reduce risk over the last 30-plus years without giving up much in the way of returns.

While a 100% U.S. stock portfolio achieved the greatest average annual return over the period, that excess return came with extra volatility. The “sweet spot” for the best risk-return dynamic in a portfolio is at the point where the curved line begins to go back on itself. In this case, an allocation of 20% to 30% to foreign shares diversifies a hypothetical portfolio of stocks, taking some risk off the table compared to a U.S.-only approach.

Opportunity Knocks

Countries across the globe have widely different economic and political policies. Some countries are ruled by dictators, others by elected officials. Some countries have pulled themselves out of recession by cutting government spending, while others have increased expenditures. As a result, various nations are in different stages of the boom-and-bust cycle that all economies move through—each country is dancing to a different tune.

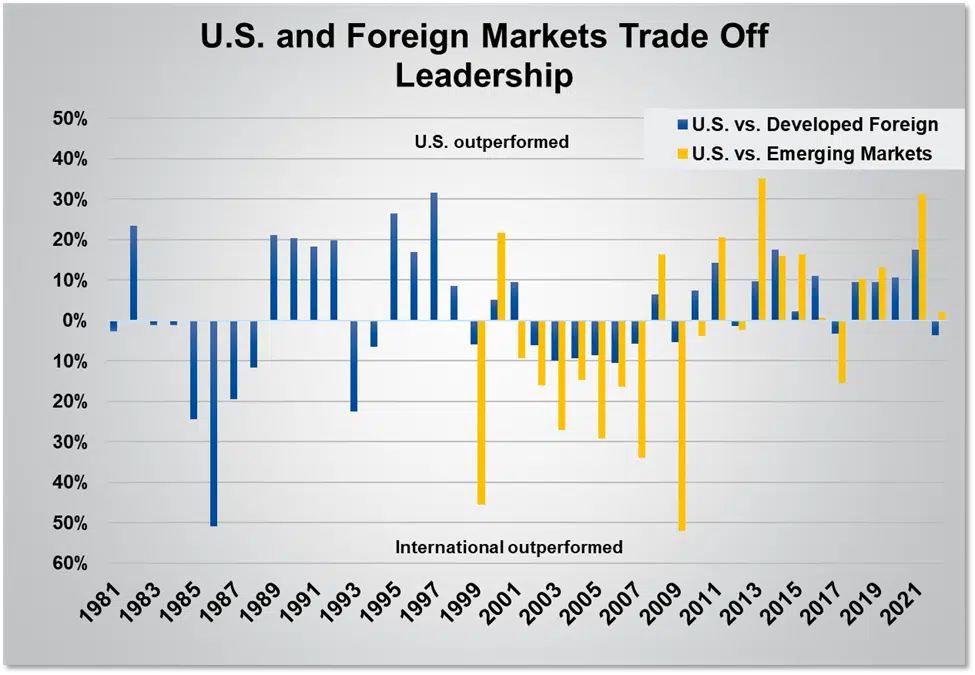

The chart above shows the difference in calendar-year returns between the U.S. stock market and developed and emerging foreign markets. When the column is above the 0% line, U.S. stocks outperformed; when it is below, foreign stocks outperformed. In particular, you can see in the recent cycle that U.S. stocks have outperformed in five of the last six years. But the chart also shows extended periods when the trend went in foreign stocks’ favor, like the aforementioned run of outperformance following the dot-com bubble bursting in 2002.

The chart above shows the difference in calendar-year returns between the U.S. stock market and developed and emerging foreign markets. When the column is above the 0% line, U.S. stocks outperformed; when it is below, foreign stocks outperformed. In particular, you can see in the recent cycle that U.S. stocks have outperformed in 11 of the last 15 years. But the chart also shows extended periods when the trend went in foreign stocks’ favor, like the aforementioned run of outperformance following the dot-com bubble bursting in 2002.

Stocks on Sale

One way to compare values in the U.S. and foreign stock markets is to look at the average price-to-earnings (p/e) ratio of stocks in those markets. The p/e ratio tells us how much investors are paying for one dollar of profit. Right now, stocks are on sale in foreign markets compared to the U.S. stock market. For every dollar of earnings earned by a U.S.-listed company, investors pay $22. In developed foreign markets, shareholders are currently paying less than $14 for that same dollar of earnings, and in the emerging markets, just $13.

Traders have typically been willing to pay higher prices for U.S. stocks because the economy was likely to grow at a faster clip than foreign economies. But today, the gap in valuations between U.S. and developed and emerging markets stocks has widened even as economic growth outside of the U.S. has picked up. This means that foreign stocks appear to be selling at enough of a discount to be highly attractive.

Building a Global Portfolio

So how much of a foreign allocation should you have? This will depend on a number of factors, including your big-picture financial and lifestyle goals, your comfort with risk, your investment horizon and more.

At Adviser, before we even look to construct an investment portfolio, we work with our clients to define their goals and understand their needs. Our wealth advisors take a holistic approach, of which investments are only a piece. Only once we have discovered what is most important to you will we build an investment strategy that aligns with those goals, whether they are raising a family, saving for retirement, buying a second home, creating a charitable legacy or something else altogether.

If you’d like help with your financial plan or investment portfolio, please contact us today for a free financial review—we’d love to hear from you!

This material is distributed for informational purposes only. The investment ideas and expressions of opinion may contain certain forward-looking statements and should not be viewed as recommendations or personal investment advice, or considered an offer to buy or sell specific securities. Data and statistics contained in this report are obtained from what we believe to be reliable sources; however, their accuracy, completeness or reliability cannot be guaranteed.

Our statements and opinions are subject to change without notice and should be considered only as part of a diversified portfolio. You may request a free copy of the firm’s Form ADV Part 2, which describes, among other items, risk factors, strategies, affiliations, services offered and fees charged.

Past performance is not an indication of future returns. Tax, legal and insurance information contained herein is general in nature, is provided for informational purposes only, and should not be construed as legal or tax advice, or as advice on whether to buy or surrender any insurance products. Personalized tax advice and tax return preparation is available through a separate, written engagement agreement with Adviser Investments Tax Solutions. We do not provide legal advice, nor sell insurance products. Always consult a licensed attorney, tax professional or licensed insurance professional regarding your specific legal or tax situation, or insurance needs.

© 2022 Adviser Investments, LLC. All Rights Reserved.