Monthly Newsletter

August 2025

What Happens to Stocks When the Fed Cuts Interest Rates?

Economy and Markets

Will they or won’t they? The rate-cut question has dogged the Federal Reserve for months. Market watchers and economists are particularly focused on the impacts of the Trump administration’s tariff policy on inflation and the job market. A lot can change over the course of a month, but based on trends in the labor market, expectations are for a rate cut following the Federal Open Market Committee’s mid-September meeting.

Let’s review the current conditions and then look to history for U.S. stock performance following the beginning of a new rate-cut cycle.

The Fed’s Mission

As you may know, the Fed has a dual mandate of providing price stability and supporting maximum employment across the U.S. economy. Its primary tool for doing so is the fed funds rate, which sets the floor on the cost of borrowing money and, in turn, influences whether businesses and consumers are more likely to spend or save.

Low interest rates tend to promote more borrowing and business spending. High rates encourage saving since bank accounts and fixed-income securities tend to pay higher interest.

Trends that typically lead to interest rate cuts are high unemployment and low inflation. On the flipside, higher inflation and a healthy job market could prompt the Fed to raise rates to cool the economy and prevent excessive price increases for goods and services.

Current Conditions Influencing the Fed

While we’ve made tremendous progress lowering inflation since its post-pandemic peak of 9.1% in 2022, that progress has slowed in recent years. Still, the annual rate of inflation has held above the Fed’s 2.0% target.

Data this month showed the July consumer price index (CPI) rose 2.7% year over year, with core inflation (which excludes the volatile food and energy segments) running at 3.1%. Meanwhile, the producer price index (PPI), which is a gauge of the costs borne by businesses, also rose in July. In combination, the CPI and PPI numbers seem to be showing President Trump’s tariffs are beginning to drive prices higher in certain segments of the economy. We expect higher tariffs will be an ongoing potential source of inflationary pressure.

On the other side of the ledger—the job market—the July employment report was one of the most disappointing in recent memory. Just 73,000 payrolls were created last month, and prior months were revised lower by a combined 258,000 jobs. While the unemployment rate ticked up to just 4.2% (still a healthy number), July marked the weakest three-month average job gain since 2020.

Following that report, Trump fired the head of the Bureau of Labor Statistics (BLS), claiming political affiliations influenced the numbers. The move raises questions about the future reliability of BLS reporting; the BLS calculates both the unemployment rate and the consumer price index each month, and market participants rely on the agency’s reports to be a nonpartisan source of truth.

This uncertainty about both inflation and the labor market means the Fed’s policymakers have a tough job ahead of them to balance that dual mandate, which is impacted by both these economic measures.

However, with inflation still within sight of the Fed’s 2% target, and the labor market showing some slippage, markets are now pricing in about an 85% probability of a September rate cut.

If the Fed cuts rates, what happens next? In theory, a rate cut stimulates the economy and markets will cheer the news. Unfortunately, it’s not so cut and dried.

Stock Market Performance Following Rate Cuts

History shows the market’s performance after a rate cut depends heavily on why the Fed is cutting rates.

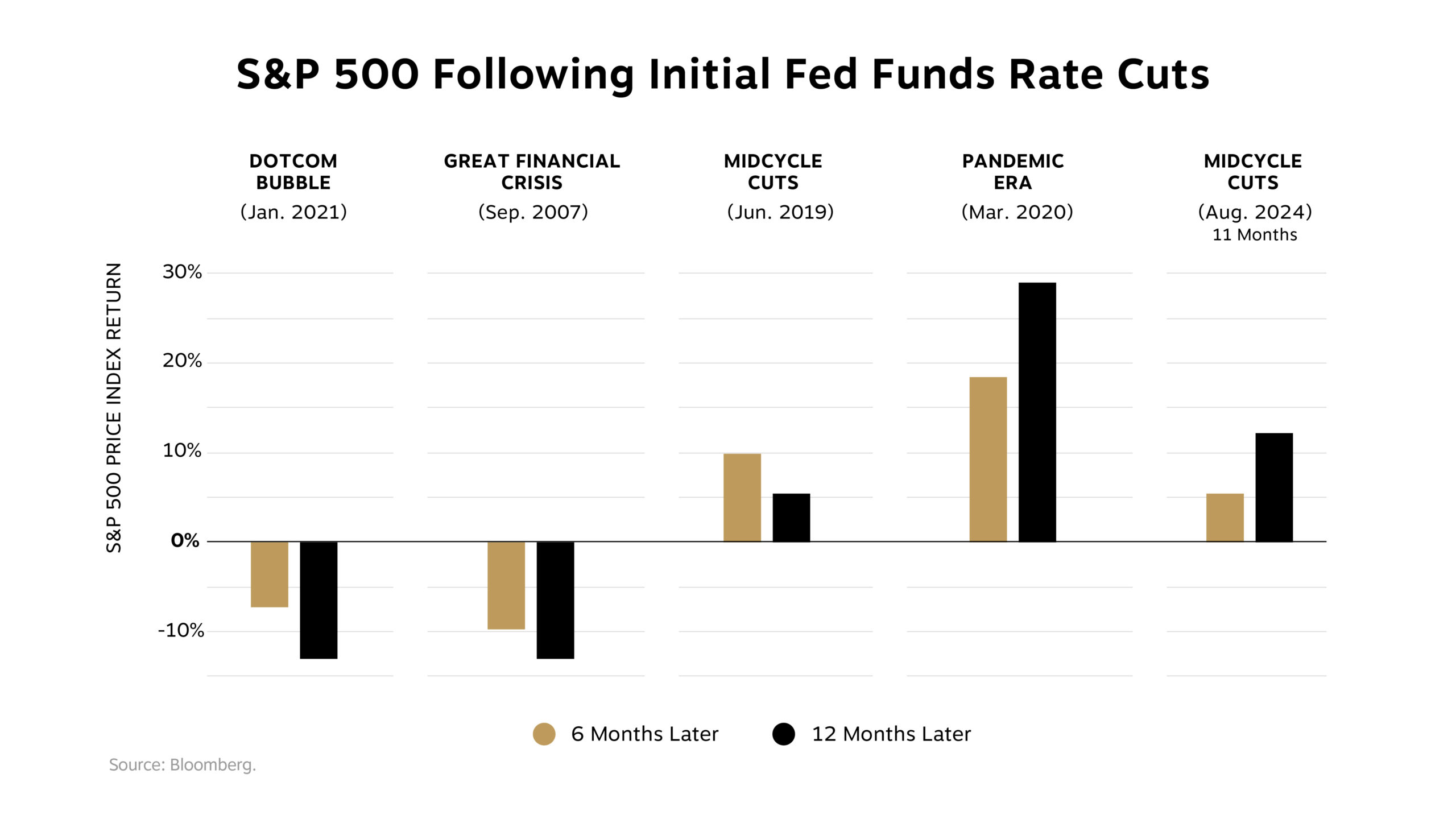

The chart below shows how stocks performed six and 12 months after the Fed made its first rate cut in a new cycle. As you can see, when cuts come as midcycle adjustments with growth still intact, like in 2019 and 2024, forward returns can be positive.

But when cuts are reactive to an oncoming slowdown, results are often negative over the short term. This is what happened after the dotcom bubble burst in the early 2000s and as the subprime mortgage crisis destabilized the financial industry beginning in 2007. (The pandemic era is in its own category—the global economic and market whiplash was so severe and sudden that it’s hard to conclude much from the data except that staying invested through short-term volatility is typically to investors’ benefit.)

Our takeaway is that the economic backdrop should be watched as closely as the policy shift itself. Markets often have knee-jerk reactions to Fed policymaking, but the relationship between stock market returns and central bank activity is complex.

When Will the Fed Decide?

The committee doesn’t officially meet until September 16 and 17, but we expect the action to pick up this month, as the Fed convenes at Jackson Hole for its annual summit. This is often a venue for the Fed chair to announce material changes to its policy stance, and we expect that will be the case again this time around. (Read CEO and Chief Economist Michelle Knight’s takeaways from the Jackson Hole symposium.)

Chair Powell needs to balance evidence of a softer job market with inflation still above target, and he’ll have to address the questions raised by trade policy as well. All this while looking over his shoulder for an impending announcement of his replacement by the president, who has publicly called for rate cuts and questioned the central bank’s policy decisions. Powell, who was appointed by Trump in 2017, is due to run the Fed until May 2026.

For the time being, the focus remains squarely on whether the Fed signals a September cut, but the turmoil at the Fed will surely be a storyline to watch in the months ahead. We are closely monitoring that situation along with economic and market data, and we’re ready to adjust your portfolios to keep them aligned with your goals as circumstances merit.

Our Latest Videos

Chief Investment Officer Joseph “JP” Powers sets the stage for the Federal Reserve’s Jackson Hole summit and its September policy meeting. Click here to watch now!

Partner and Wealth Advisor Jeff Menning, CFP®, reviews impactful provisions from the One Big Beautiful Bill Act and what they mean for your taxes this year and beyond. Watch here.

Roth Conversions: A Strategic Move for Your Wealth

Tax Planning

A well-orchestrated tax strategy is essential to help build and preserve your wealth. Roth conversions are one of the most powerful tools in that arsenal. Bob Johnson, one of our senior tax colleagues, shares his perspective on the strategy and who can potentially benefit.

Let’s explore how converting pretax retirement assets into a Roth IRA may unlock long-term tax-free growth, potentially bolster your financial resilience and help set your legacy on solid ground.

What Is a Roth Conversion?

A Roth conversion is the process of moving funds from accounts where your savings have grown tax-deferred. These might include a traditional IRA, SEP IRA or 401(k). Then, you convert this money into a Roth IRA (or merge it into an existing Roth if you already have one).

Upon conversion, you pay income taxes on the converted amount in that year. Once the funds are converted to a Roth, your money grows tax-free and qualified withdrawals (including for heirs) remain tax-free as well.

Why consider this move? The big advantage is control. By strategically timing conversions during years when your income tax rate is lower, you may be able to reduce your lifetime tax bill and potentially leave a more tax-efficient legacy.

When Are Roth Conversions Most Powerful?

The ideal window often arrives after retirement but before required minimum distributions (RMDs) begin and before Social Security benefits kick in. During these lower-income years, you may find yourself in the 10% to 24% tax brackets. If you anticipate higher tax rates in the future, converting now can mean substantial tax savings down the road, both for your own retirement cash flows and for any beneficiaries.

Key Considerations: Look Beyond the New Tax Bill

While understanding the up-front tax cost is important, our job is to help you consider related implications so you don’t overlook anything crucial, including:

- Medicare’s IRMAA surcharge. If you’re on Medicare or will be soon, keep IRMAA (income-related monthly adjustment amount) in mind. Higher modified adjusted gross income (MAGI) can mean you’ll pay surcharges on your Medicare Part B and Part D premiums. These are “cliff” thresholds—with no phaseout—so even a small conversion that nudges you over the line can have an outsized effect on your cash flow.

- Hidden costs in the tax code. Roth conversions can temporarily inflate your income and trigger phaseouts for valuable deductions and credits. For example, the new One Big Beautiful Bill Act increased the state and local tax (SALT) deduction cap to $40,000, significantly benefiting those in high-tax states. However, these deductions begin to phase out once MAGI surpasses $250,000 (single) or $500,000 (married filing jointly), potentially limiting your benefit.

- New senior deduction limits. There’s now a $6,000 deduction available per taxpayer over age 65—or $12,000 if both spouses are over 65. However, this benefit phases out for higher earners, with income limits at a MAGI of $75,000 for single taxpayers and $150,000 for those married filing jointly. If a Roth conversion elevates your income above these thresholds, you could lose access to this valuable deduction, impacting your overall tax efficiency.

Comprehensive Tax Planning for Every Stage of Your Life

Your tax strategy should never be an afterthought. We integrate year-round planning across investments, income sources and estate intentions, ensuring that moves like Roth conversions aren’t executed in a vacuum, but as part of your larger, integrated wealth strategy. Continuous tax optimization, strategic gifting, navigating complex deduction landscapes and more—our experienced professionals guide you confidently at every step.

The Bottom Line

Roth conversions can be a game changer but must be tailored to your unique financial journey. Together, we can evaluate not just your immediate tax bill but the full, multiyear impact on your wealth and your legacy. Ready to optimize your retirement and broaden your options? Let’s chart the course thoughtfully, strategically and with your goals in mind. Call your advisory team to continue the conversation and find out if a Roth conversion is right for you.

Renting Versus Buying a Vacation Home: How Do You Decide?

Lifestyle Planning

You’ve come home from a dream vacation and already want to go back. Maybe you fell in love with the sights, the community or the idyll, but visions of a home away from home are filling your head. What if you had a place of your own in that perfect vacation spot?

Before you pull the trigger and put in an offer, you should take a step back and ask yourself: “Should I buy, or should I rent?”

With home prices and mortgage rates across the country still high and average rents rising faster year over year post-pandemic, this question is more nuanced than ever.

Here are four financial questions to consider as you navigate this complex (and pricey) housing market:

- What’s my time frame? The longer you plan to hold on to the home or vacation destination, the more financial sense it makes to buy. If you don’t see yourself keeping a house for at least three to five years, it likely won’t appreciate enough to justify the transaction costs of buying and selling. In this case, renting may make more sense.

- What’s the true cost of ownership—and can I afford it? You have to build more than just the principal and interest payments on your mortgage into your budget; there are also property taxes, utilities and insurance. And plan to spend 1% of the home’s total value annually on maintenance.

The question becomes: “Can I afford to buy?” A simple rule of thumb is to add up the monthly principal, interest, taxes and insurance payments, then divide by your monthly gross (pretax) income. If your total housing costs are greater than 28% of your income, you may be stretched too thin—renting (or buying a less expensive home) is the safer call. - Will I save on taxes? A mortgage interest deduction is often touted as a reason to buy. But keep in mind: Before tax laws changed in late 2017, homeowners could deduct interest on mortgages worth up to $1,000,000. Now that’s down to $750,000 (and this change is permanent as of 2025). What’s more, you must itemize your taxes to take advantage of any mortgage interest deductions. Because of those same tax-law changes, many owners don’t see any benefit to itemizing because of the increase in the standard deduction (in 2025, it’s $15,750 for single filers and $31,000 for spouses filing jointly).

- What are my opportunity costs? This question is one you may not think to ask yourself, but it’s how financial planners analyze decisions like these: If you invest your down payment in the stock market instead of using it to buy a house, what rate of return could you reasonably expect? Or what if you simply deposit that money in the highest-yielding savings account you can find?

Likewise, if you could rent a similar property for less per month than your total monthly costs of ownership, how much would you gain by investing the excess savings every month? It pays to do your homework and look at homeownership through an investment lens.

Of course, the rent or buy question goes beyond just the financials. Some people value the flexibility that comes with renting. Others feel more connected to their community when they own their home. We’ve focused on the financial side of renting versus buying, but don’t discount the emotional aspects of this decision.

If you have any questions about what’s best in your specific situation, please contact your advisory team. We are happy to help you work through the numbers and other considerations.

Honoring Sue Irwin (1961–2022): A Legacy of Service, Compassion and Hope

The Power of Relationships

Partner and Wealth Advisor David Mastroianni, CFP®, remembers a beloved colleague and shares how her family has kept her spirit alive by fundraising for Swim Across America.

At RWA Wealth Partners, the memory of our dear friend and colleague Sue Irwin continues to shine as a guiding light for all of us. Sue’s career was woven into the very fabric of our firm: Joining in December 1995, she became the first full-time employee of our legacy Adviser Investments business. Over her remarkable 25-plus years here, Sue touched countless lives with her integrity, warmth and dedication, not only as an exceptional advisor but as a mentor, confidante and true friend.

Sue’s work ethic was legendary! She never hesitated to go above and beyond for our clients, our colleagues and those who depended on her guidance. Her sharp wit, generous laugh and genuine interest in others created a sense of true family within our office walls. Sue was always among the first to welcome newcomers, eager to share a smile at every company event and ready to lend a hand. She taught us the importance of relationships, showing daily that caring for others is the heart of what we do.

As her close friend and colleague, I’ll never forget one of the last I things I said to her: “Sue, no matter what happens, you’ll always be my hero.” Every day I’m reminded by the example she set at the company. Sue embodied the saying that “Leadership is doing the right thing when no one else is looking.”

Sue’s commitment to helping others extended far beyond her professional life. She was an active volunteer and especially passionate about Swim Across America, which is a nonprofit organization that raises money to support cancer research and patient programs. Sue and her family have long been involved with Swim Across America’s charity swims across Long Island Sound, turning personal battles into community triumphs.

This Year’s Swim Across America Long Island Sound Event

In late July, Team Irwin once again dove into the waters of Long Island Sound in Sue’s honor, gathering friends, family and colleagues to keep her spirit alive in the fight against cancer.

Thanks to the tireless efforts of Sue’s brother Tim and the entire Team Irwin, this year’s event was an incredible success:

- Team Irwin raised over $71,000 for cancer research and patient programs.

- The broader Swim Across America Long Island Sound event has helped raise nearly $2.1 million at last accounting.

RWA was proud to sponsor Team Irwin once again as they joined hundreds of swimmers and volunteers in making a lasting difference. The generosity, teamwork and camaraderie on display perfectly captured the values that Sue embodied every day.

Keeping Sue’s Memory Alive

Sue’s legacy lives on through the relationships she built, the lives she touched and the causes she championed. We’re going to ensure that Sue’s compassionate spirit remains at the heart of our RWA community. As we reflect on all that she gave, we are reminded to care deeply for one another and to support efforts that bring hope, healing and progress.

Thank you to everyone who swam, volunteered and supported Swim Across America this year. With each paddle, kick and contribution, we honor Sue’s incredible legacy and move closer to a world without cancer.

By providing your email address you consent to receive marketing content from RWA Wealth Partners, LLC.