Newsletter

VOLUME 04 | April 2024

RWA Wealth Outlook

Sticky Inflation and Heated Elections

After reaching new all-time highs in the first quarter, equity markets gave up some ground in April due to evolving rate-cut expectations. This, combined with sticky inflation, the election cycle onslaught and geopolitical turmoil, may have investors wondering if it’s time to dust off an old seasonal strategy and sell out of this market in May.

As the legend goes, stockbrokers would “sell in May and go away,” moving their portfolio to cash and taking a summer vacation (from the office and the markets) before returning each fall. The so-called Halloween indicator picked up traction over the years after a series of large, memorable sell-offs occurred during this period, including on Black Monday 1987, following 9/11 and during the height of the global financial crisis in 2008.

But this is not a consistent strategy. While it has worked in certain years, there have been long stretches where it has not, and more recently several large sell-offs have occurred in the “off” months—for example, the nearly 20% pullback over three weeks in December 2018 during the trade war with China, the pandemic panic in March 2020 and the painful start to 2022. Unfortunately, we can’t rely on the calendar to dictate an investment strategy.

Since a summer-long market vacation is not advisable, what can we expect in the coming months?

We have good reason to believe the economy and markets have room to run, though the ride may not be smooth or comfortable. We face some very real risks and the inherent uncertainty of investing—but that’s why we plan so carefully around your goals instead of current events or the calendar.

Earnings a Tailwind for Stocks?

The U.S. stock market is in a bull market and hit multiple all-time highs this year on the way to a 10.6% Q1 gain before retreating this month. Over the same period, the bond market was down 0.8%, and yields are up as investors seek to price in the impact of a “higher for longer” interest-rate policy due to stubborn inflation.

While the artificial intelligence theme has been dominant, we saw signs in March that the stock market rally could broaden beyond the tech-centric Magnificent Seven to other sectors. Foreign markets have also made gains this year—good news for diversified investors.

Company earnings expectations show that the bull market can keep running. Wall Street projects that S&P 500 members will show 3.4% annual growth in earnings per share in Q1. Notably, profits for the Magnificent Seven cohort are on course to jump 38% in the first quarter.

If corporate earnings are much stronger than expected overall, the size and timing of Fed rate cuts may not have as much influence on the markets. And while concerns about stock valuations are valid, consider that the Magnificent Seven trade at a significantly lower valuation metric (average forward P/E multiple of 28) than the top 10 stocks did during the dot-com bubble in 2000 (average forward P/E multiple of 49).

Potential Turbulence Ahead

The biggest foreseeable challenges on the horizon for investors are the U.S. election this fall and the possibility of a broadening conflict in the Middle East.

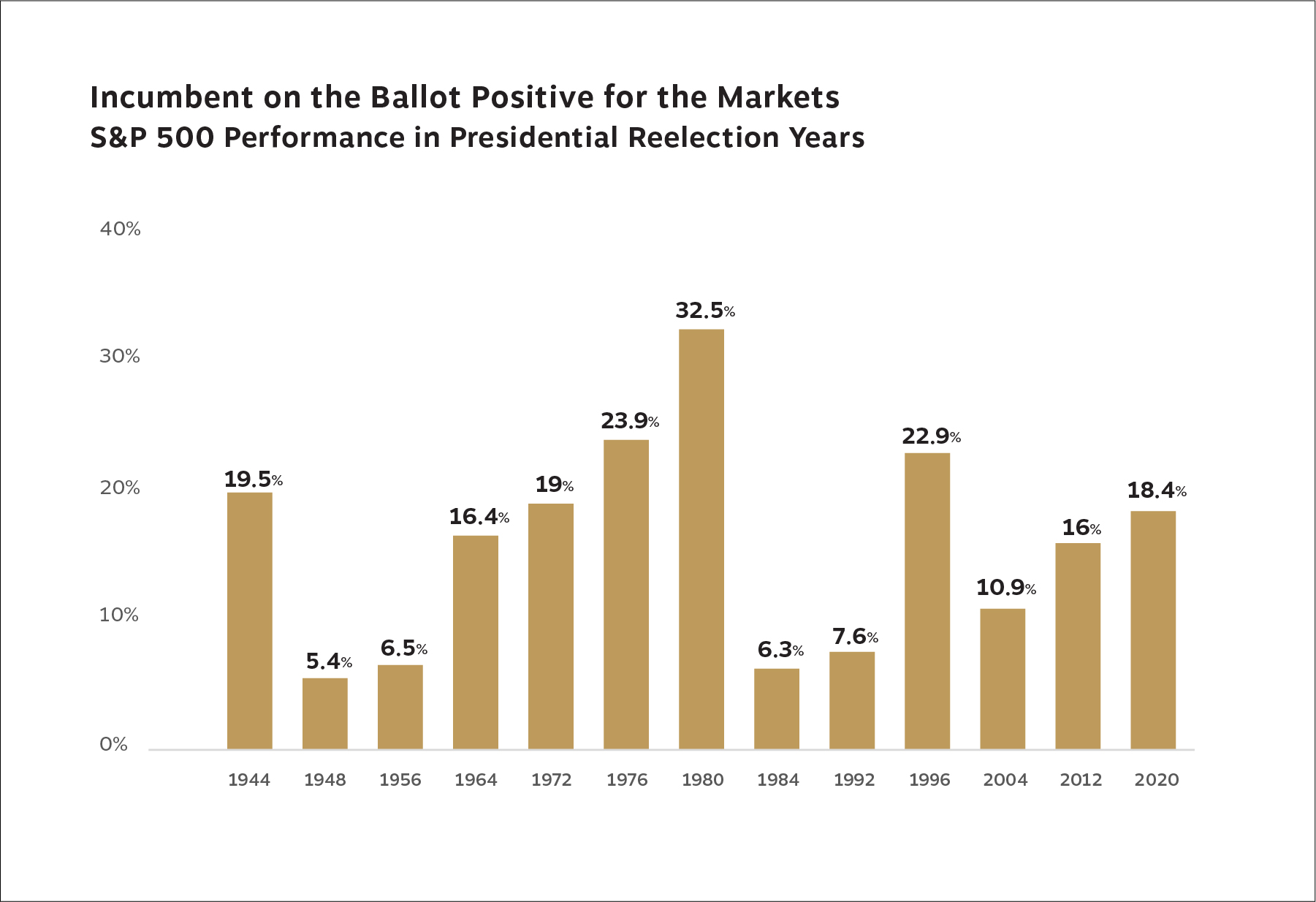

The chart below offers some perspective on what happens during election years when the incumbent is on the presidential ballot. You can see that stocks have gained in the 13 such instances since 1944. As election season becomes more emotionally charged and widens divisions across the political spectrum, our job is to filter out the noise and continue to act in your best financial interest.

We’ll have more on this topic in the months ahead, but remember that making portfolio allocation decisions based on politics and elections carries a significant risk of derailing your plans. Your goals, income requirements, lifestyle needs and comfort with investment risk comprise the soundest foundation on which to build an enduring wealth strategy. Please speak to your advisor if you have concerns about election outcomes as they relate to your financial plan.

Beyond the horrific human toll and the destabilizing impact armed conflict has on global and regional diplomatic relationships, it can also create price pressure on commodities. Oil prices are creeping higher, and hostilities between Iran and Israel caused speculation that the cost could spike to over $100 a barrel. Iran is the third largest producer in OPEC and 20% of global oil production flows through the Strait of Hormuz along Iran’s southern border daily, so the impact of sanctions or escalating aggression on supply are a concern.

Direct exposure to oil and energy stocks is currently low in our core portfolios, but the ripple effects of higher energy prices on travel, transport and consumer budgets are far-reaching. We’ll be keeping a close watch on oil this summer and will adjust portfolios as necessary.

Gauging Consumers, the Job Market and GDP

The labor market is strong, and low unemployment supports consumer confidence. The March retail sales report showed an increase of 0.7% last month, higher than the 0.4% expected. We are not a nation of savers: When the job market is near full employment and consumers are confident, they spend. That spending supports our economic growth, as roughly 70% of U.S. GDP is tied to consumption.

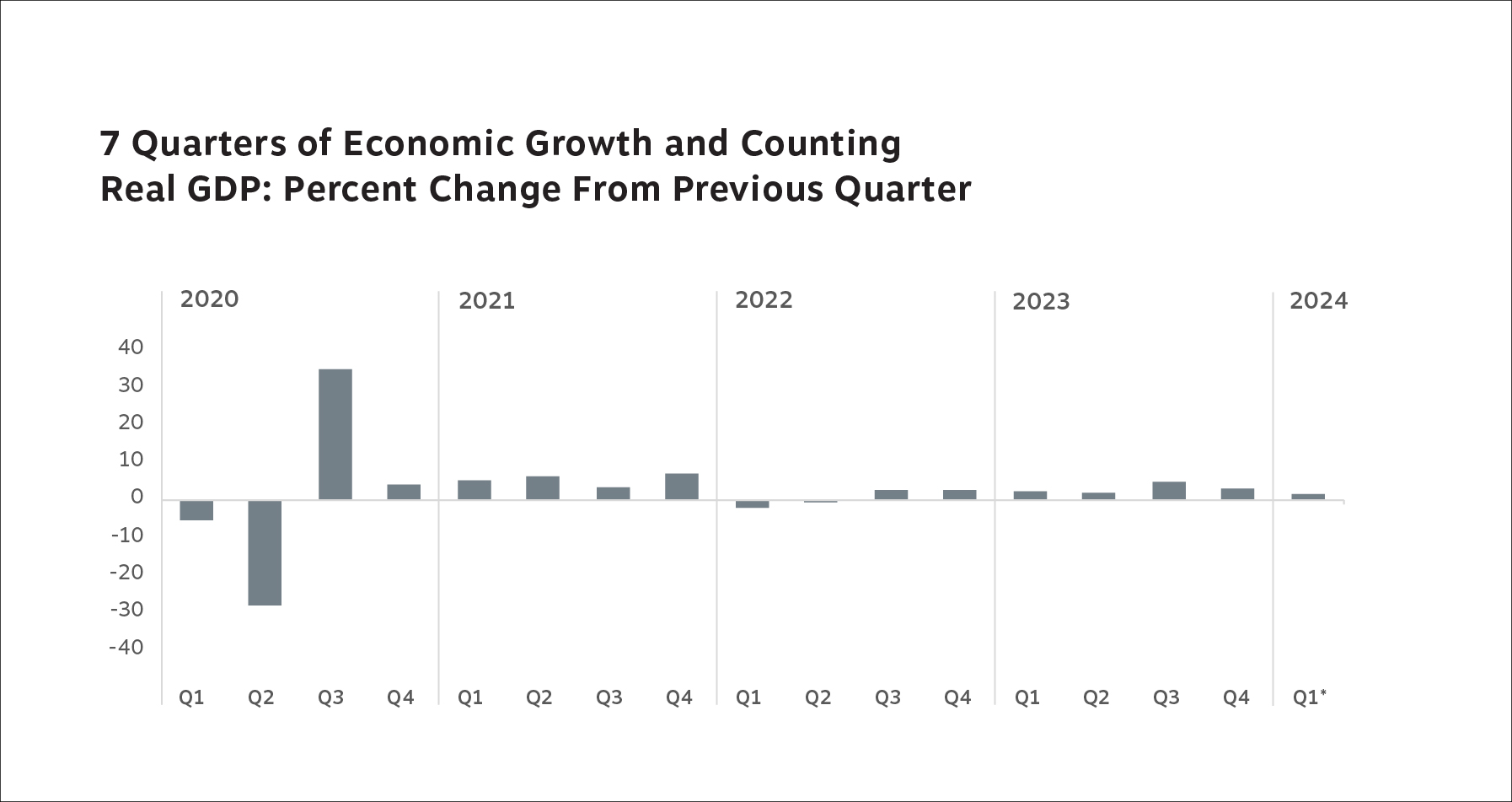

And the economy has been growing, though some signals are mixed. GDP grew at a 3.4% annual pace over the last three months of 2023 and 1.6% in Q1 2024 according to the advance estimate from the Bureau of Economic Analysis—lower than expected. While concerns about an inverted yield curve, stubborn inflation and the housing market linger, we’ve seen more evidence of a soft landing for the economy than we have of a recession. Is a recession still possible? Of course. Is a recession probable? Not anytime soon.

Plotting Federal Reserve Policy

We put the Federal Reserve square in our sights at the beginning of the year, anticipating that investor reactions to the central bank’s fight against inflation would sway the market in 2024. And that’s what we’ve experienced.

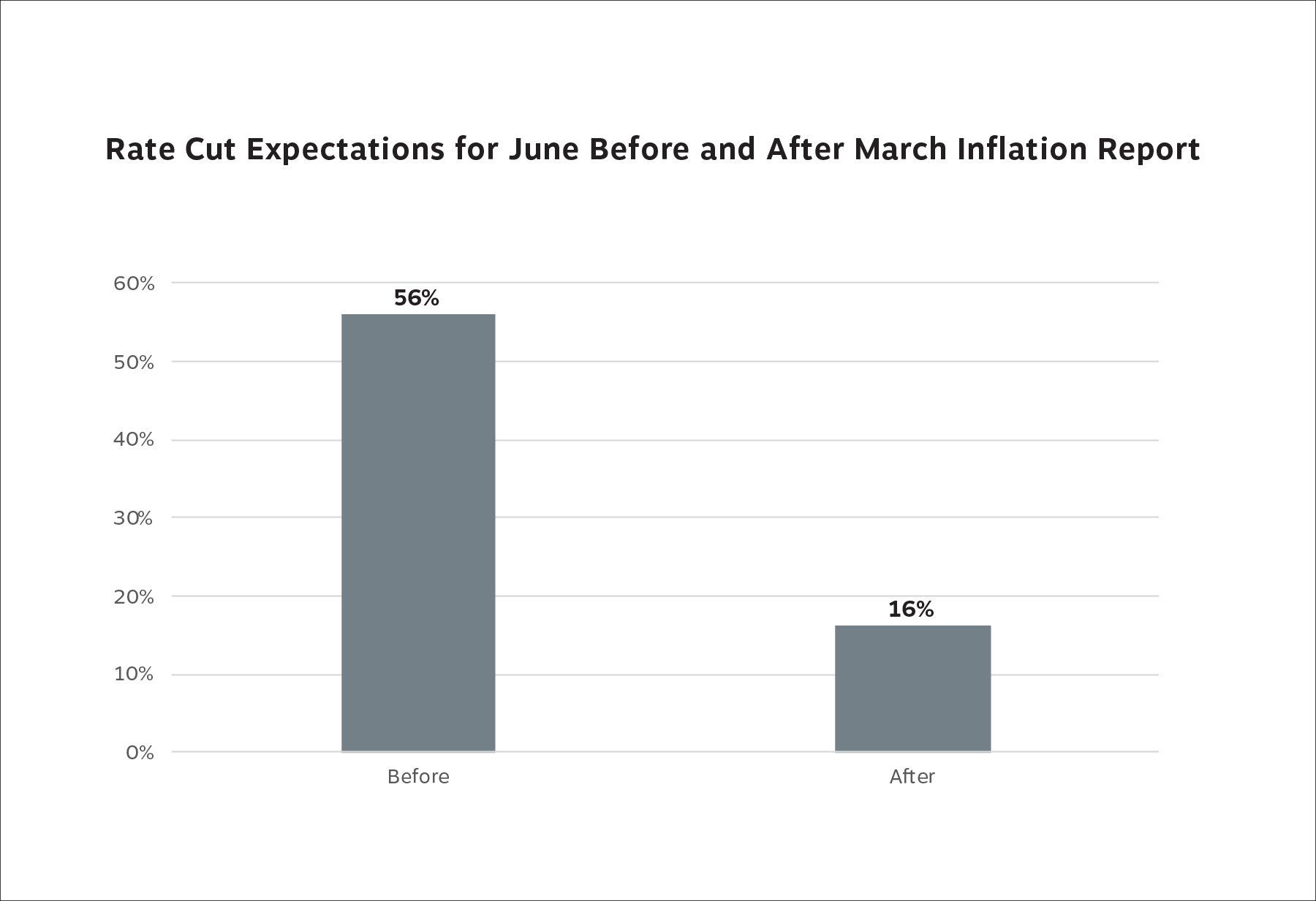

The surprise March inflation report is a recent example. Consumer prices rose 3.5% year over year, rattling analyst assumptions that inflation would trend lower and the Fed would cut interest rates in June. After the report, rate policy expectations changed, and stocks pulled back.

The chart below shows expectations for a 25-basis-point rate cut on April 9 (the day before the March inflation report) and where they stood on April 10 (after the inflation surprise). Confidence in a rate cut fell 40% in mere hours. Short-term moves like these (and the accompanying negative 1% one-day reaction in the stock market) make for snappy media sound bites, but they’re unreliable long-term investment indicators.

Instead, it’s our longstanding belief that earnings and interest rates give the strongest indications of where stocks are heading.

Positioning Portfolios for Your Goals

As mentioned above, earnings expectations for Q1 are positive. According to FactSet, forward-looking projections show average S&P 500 earnings growing by 10% this year and 14% in 2025. Given the chances for volatility ahead, we continue to believe that underweighting small- and mid-cap U.S. stocks while overweighting large-cap U.S. stocks offers a combination of stability and long-term growth potential to investors. We’ve positioned portfolios accordingly while maintaining diversification across U.S. sectors and the globe.

On the interest-rate front, higher for longer means that bonds across the spectrum will continue to offer attractive yields. Further, we’re seeing tight yield spreads between high-quality investment-grade bonds and lower-quality high-yield bonds, which has a couple of implications. Tighter spreads typically appear during a positive economic environment. But this also means that the compensation for taking on more risk in high-yield and lower-quality bonds is just not there. Until this dynamic changes, we favor higher-quality bonds in the fixed-income portions of our core portfolio strategies. We believe patience is key, especially given uncertainty over the Fed’s next move.

It’s also worth repeating our caution that cash, which appears attractive because of its higher yield, has a greater reinvestment risk when the Fed cuts rates. This is because rate cuts provide no benefit to cash and money market holdings. Their yields will closely follow the fed funds rate downward, but their prices will remain stable ($1 is always $1). In contrast, bonds gain a tailwind from rate cuts—yields will fall, but prices will rise. Our approach is to maintain cash levels with an eye for liquidity needs and lifestyle expenses, and we aim to mitigate reinvestment risk, treating cash as more of a strategic reserve than a growth opportunity.

Eyes on the Horizon

We continue to work toward your goals and believe our preparation for turbulence positions your portfolios to manage market risks while participating in the ongoing bull market. An emphasis on large-cap stocks, high-quality bonds and conservative global diversification in our core portfolios is designed to provide firm footing and keep you on track in the months ahead.

As always, thank you for your partnership and trust. Your advisor and the entire RWA Wealth Partners team are here to support you and help you achieve your goals. Call today if you have questions about your financial plan or want to get a head start on tax planning for next year.

7 Strategies to Boost Your Wealth

Equity Compensation

In our last issue, we highlighted common types of equity compensation along with the tax and financial planning opportunities and complexities involved. This month, we examine strategies to make the most of your awards.

Equity compensation can change the trajectory of your wealth. Beyond securing your own well-being, it offers the opportunity to leave a lasting impact on your family and society at large.

However, unlocking its full potential requires integrating this compensation into your financial plan. Know the rules, features and deadlines associated with your stock awards, and collaborate closely with your advisor to devise a tailored approach. Our in-house experts at RWA Wealth Partners emphasize the following considerations:

- Avoid concentration risk. Any time you own an outsized stock position in your investment portfolio, you risk disproportionate losses when the stock loses value.

If you tie too much of your wealth up in company stock and your employer runs into trouble, you could lose your both your job and the value of the equity you own. While this is unlikely, it is a potential threat to your wealth. Think Enron, Bear Stearns, Lehman Brothers. Our experts recommend holding no more than 10% to 20% of your net worth in company stock to reduce this probability. If concentration gets too high, depending on your situation, you should look for ways to rebalance your portfolio without incurring a large tax bill, either by selling or donating the stock. Another potential strategy is to create an options overlay that offers insurance against the position.

- Sell RSUs at vesting. If you own restricted stock units (RSUs), consider selling the position at the time of vesting and allocating the funds into a diversified portfolio. While this means you pay income taxes at vesting, it minimizes concentration risk and the potential impact of a long-term capital gains tax bill when you sell in the future. Talk to your advisor about whether this is the right strategy for you.

- Employ 83(b) elections. If you have restricted stock awards (RSAs), incentive stock options (ISOs) or non-qualified stock options (NSOs), an 83(b) election can mitigate taxes you owe. This permits you to pay taxes on your unvested options or RSAs within 30 days of exercise or grant. You pay income taxes on the fair market value at the time of granting and then long-term capital gains taxes on any appreciation when you sell shares a year or more later. 83(b) elections are not without risk, however. If the stock declines in price, you will have paid taxes at a higher rate than the value of the shares. And if you leave the company before you receive the vested shares, you’ll have paid taxes on stock you never end up owning.

- Exercise NSOs when income is low. With NSOs, you can choose when you want to incur taxes before the options expire. So try to exercise them in the years you expect to earn less and are likely to be in a lower income tax bracket.

- Participate in ESPPs only under certain conditions. Consider taking part in employee stock purchase plans (ESPPs) only if they offer a 10% to 15% discount, allowing you to buy stock at a more favorable price. Depending on the maturity of your company, your advisor may recommend selling at vesting or holding for appreciation.

- Know your dates and deadlines. Missing deadlines or exercising at the wrong time can create tax nightmares and erode the value of your equity compensation. Being organized and understanding when to act is imperative. Talk to your advisor for help.

- Use CRTs to lower taxes and create income. If you end up with a highly appreciated position in company stock, a charitable remainder trust (CRT) is a great option for avoiding a large tax bill. It creates a charitable deduction, and it also provides an income stream for yourself and your family. You can use a CRT to support your philanthropic legacy, making a difference for causes that matter to you.

Next Steps

This is the time of year when executives are receiving new equity awards and grants from prior years are vesting. The complexity of equity compensation can confound even the savviest investors, but working with your trusted advisor, you can create a legacy for generations. Talk to your financial advisor about the withholdings on your vested stock, tax planning for 2024 and beyond, your projected income and more.

Making Sound Decisions

Remembering Daniel Kahneman

The academic and financial worlds mourned the loss of renowned psychologist, economist, author and Nobel Prize winner Daniel Kahneman, who passed away last month. Kahneman advanced the understanding of human judgment and exposed the hidden biases underlying our decisions.

Kahneman and his colleague Amos Tversky spent decades studying human behavior. They showed that while we think our decisions are rooted in good reasoning and rationales, the opposite is true. In other words, we believe our reasoning because we’ve already made our decision. It’s a profound discovery with wide-ranging implications—particularly in the high-stakes world of investing.

Kahneman’s insights reveal the extent to which humans act in irrational ways. But by understanding our embedded biases, we can correct for them.

Investor Biases

Kahneman and Tversky identified three cognitive biases (or heuristics) that are especially relevant to investors: Loss aversion, the anchoring heuristic and availability bias.

For example, they showed that for most people, the fear of loss outweighs the promise of gain by a factor of 2 to 1. Put simply, the pain of losing $20 feels twice as bad as gaining $20. Think about times in your life when you’ve lost something of value versus gained something—which stands out more in your memory?

Loss aversion can seriously affect financial decisions. The fear and pain of losing money makes us less likely to invest even when evidence suggests high probability of a gain.

The anchoring heuristic comes into play when our decisions rely too much on the first piece of information we receive—even if that information is irrelevant or questionable. Once that anchor is set, it’s hard to dislodge it. For example, investors may base their valuation of a stock on its current price without considering how it got to that price and why. We see this happening in the markets today with stocks related to artificial intelligence, and we witnessed it during the meme stock fad several years ago.

Availability bias (also known as recency bias) is our tendency to make decisions based on what we remember most easily. If something is more readily available in memory, as most recent experiences are, we perceive it as being more likely to happen again. We observe this behavior any time the markets rise or fall significantly. After big gains, investors will take greater risks; when markets crash, investors become risk averse. Either way, it can harm financial health and impact progress toward long-term goals.

These are just three investor biases that can undermine our decisions in irrational ways. Recognizing their effects is the first step in separating emotion from decisions best made with dispassion.

Kahneman once said, “Happiness is determined by factors like your health, your family relationships and friendships, and above all by feeling that you are in control of how you spend your time.” We agree—this is the human side of wealth that we want you to experience. It’s why we take the time to understand your goals and concerns, getting to the core of what matters most to you so you can focus on your health, family and friendships.

This material is distributed for informational purposes only. The investment ideas and opinions contained herein should not be viewed as recommendations or personal investment advice or considered an offer to buy or sell specific securities. Data and statistics contained in this report are obtained from what we believe to be reliable sources; however, their accuracy, completeness or reliability cannot be guaranteed.

Our statements and opinions are subject to change without notice. You may request a free copy of the firm’s Form ADV Part 2, which describes, among other items, risk factors, strategies, affiliations, services offered and fees charged.

All investments carry risk of loss. Past performance is not an indication of future returns. Diversification does not ensure a profit or protect against a loss. Options involve risk and are not suitable for all investors. Tax, legal and insurance information contained herein is general in nature and should not be construed as legal or tax advice, or as advice on whether to buy or surrender any insurance products. Personalized tax advice and tax return preparation is available through a separate, written engagement agreement with our wholly owned subsidiary, RWA Tax Solutions, LLC. We do not provide legal advice nor sell insurance products. Legal services may be available via a separate, written engagement agreement through our exclusive relationship with Hall & Diana LLC.

Always consult a licensed attorney, tax professional, or licensed insurance professional regarding your specific legal or tax situation or insurance needs.

Companies mentioned in this article are not necessarily held in client portfolios, and our references to them should not be viewed as a recommendation to buy, sell or hold any of them.

© 2024 RWA Wealth Partners, LLC. All Rights Reserved.