HSA Spells Tax-Free Investing

It might seem like the holy grail every investor is looking for: A way to shelter a portion of your income for spending later in…

Adviser Investments and Polaris Wealth Advisory Group are now RWA Wealth Partners.

Attaining confidence in your retirement plan can be an elusive pursuit, even once you achieve financial success. A study1 found that 58% of high-net-worth individuals…

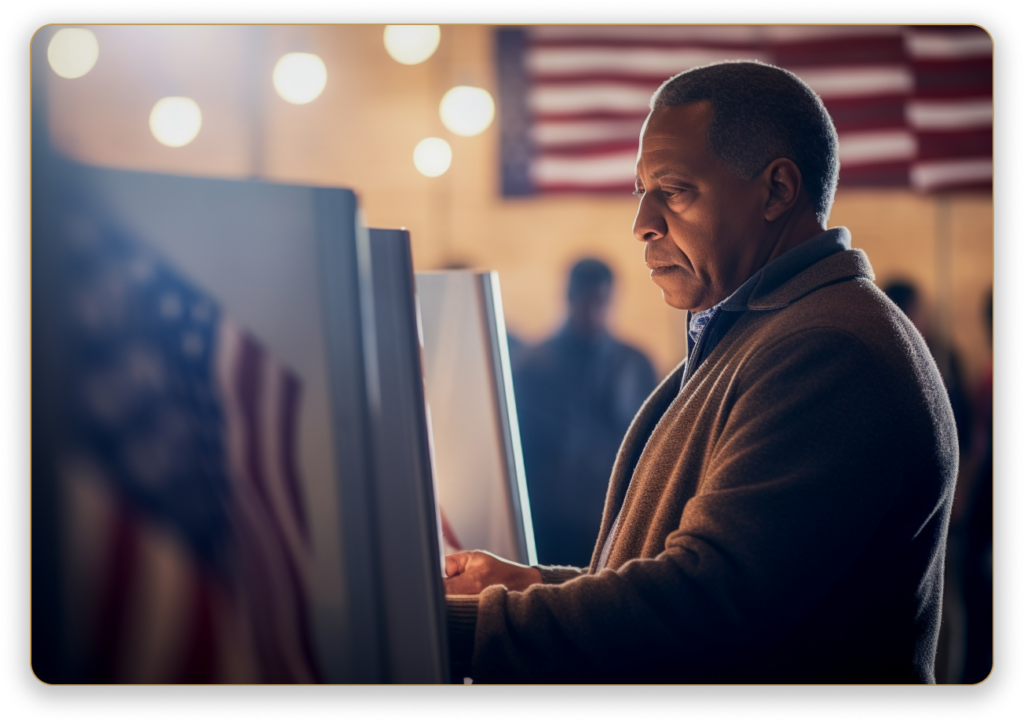

Please join us for a special presentation and learn strategies to help protect more of your wealth from the IRS. Hear our advice on how to maintain focus on your financial goals and not the upcoming elections.

It might seem like the holy grail every investor is looking for: A way to shelter a portion of your income for spending later in life—without having to pay taxes on it, unlike with an IRA. What’s the vehicle that can make this a reality? A health savings account (HSA). If you qualify, HSAs are worth a look. Health savings accounts are one of the most tax-efficient savings vehicles around, offering triple tax benefits: You contribute pretax dollars You pay no taxes on the earnings And, if used for medical expenses, you withdraw the money tax-free Many of us treat HSAs like flexible spending accounts (FSAs). We tap into them to pay for qualified medical expenses as they arise. But this powerful savings…

It might seem like the holy grail every investor is looking for: A way to shelter a portion of your income for spending later in…

Drawing upon Adviser Investments’ decades of experience, our comprehensive estate and legacy planning checklist includes a glossary of key terms and identifies five critical estate…

Traditionally, when we talk about estate planning tools, we focus on revocable trusts—an incredibly important and versatile wealth management tool. But that’s not the end of…

Let’s begin.

Required fields