Ropes Wealth Advisors is now RWA Family Office, a division of RWA Wealth Partners.

Investing Through Volatility

As March Madness captivates sports fans with its thrilling upsets and bracket-busting surprises, we can’t help but see parallels to the investment world. Just as college basketball fans must ride out the uncertainty of tournament play, investors face their own versions of “market madness” throughout the year.

When markets become turbulent, even experienced investors can feel uneasy watching their portfolio values fluctuate. Larger portfolios often mean larger dollar swings during market drawdowns, which can be tough to bear. Yet building and preserving wealth requires maintaining perspective and discipline, especially during uncertain times. That’s why it’s important to work with your advisor on a game plan that won’t let market declines “bust your bracket.”

Understanding Market Corrections: Downturns Are Normal

In mid-March, the S&P 500 index (a benchmark for large U.S. company stocks) fell into correction territory when it declined 10% from its prior high. But corrections—periods when investments drop in value temporarily by 10% or more—are not unusual events. They’re regular features of healthy markets. As you can see in the chart below, the data tells a compelling story: Despite experiencing average drops of 14% during a given calendar year, the S&P 500 has delivered positive annual returns in 34 of the past 45 years.

This pattern is striking. Even in years with positive returns, investors regularly endured significant declines along the way. In 2009, for example, the market dropped 28% at one point before finishing with a 23% gain. In 2020, a dramatic 34% decline during the pandemic still resulted in a 16% gain by year’s end.

Having this historical perspective helps transform alarming headlines into isolated episodes within a broader wealth-building journey.

Spreading Your Investments: The Power of Diversification

We believe a well-balanced portfolio of stocks and bonds remains the cornerstone of successfully investing through market volatility. That’s why we craft personalized portfolios attuned to your risk comfort and long-term goals. We base our approach on the following principles:

True diversification means portions of your portfolio will occasionally move in different directions—when one area underperforms, another may outperform. This isn’t a flaw but rather evidence that your strategy is working exactly as designed to help you weather market volatility.

Rebalancing: Turning Market Swings Into Opportunities

Periodically rebalancing your portfolio (resetting investment percentages back to your original targets) serves multiple purposes:

We monitor your portfolio’s allocations throughout the year and periodically rebalance on your behalf. We believe this transforms market volatility from a concern into a potential advantage. (Click here for more on the benefits of rebalancing.)

Stay Invested: Timing the Market Rarely Works

Even sophisticated investors can be tempted to move in and out of markets based on momentum or emotion. However, research consistently shows how difficult this is to do successfully. Missing just the five best market days between 1980 and 2023 would have significantly reduced a portfolio’s long-term performance.

The most successful wealth strategies keep you invested in the market through full cycles rather than attempt to avoid declines. This is particularly important since many of the market’s strongest days occur during periods of increased downside volatility.

Strategic Opportunities During Market Downturns

Market volatility creates several strategic opportunities:

Your Mindset: Your Greatest Advantage

Often, the biggest threat to long-term performance isn’t market volatility itself but our reactions to that volatility. Here’s how you can stay on track:

The Long-Term Perspective

When viewed over decades, even significant market events—from the 1987 crash to the 2008 financial crisis to the pandemic sell-off—appear as temporary interruptions in a larger wealth-building journey. The data is clear: Markets have historically rewarded patient, disciplined investors.

Maintaining this perspective—especially when headlines suggest otherwise—is often what separates those who simply preserve wealth from those who grow it over time.

Much like a well-constructed March Madness bracket requires looking beyond individual biases to pick the teams that will go the distance, successful investing means not letting short-term market volatility derail your long-term strategy. By understanding market patterns, diversifying wisely, rebalancing regularly and maintaining discipline, you can confidently navigate the madness of the markets without letting temporary declines bust your long-term financial bracket.

Our Latest Videos

This month, Chief Investment Officer Joseph Powers discusses how markets have turned away from the Magnificent Seven and U.S. stocks three months into 2025 and where he’s seeing opportunity.

Click here to watch now.

In addition, Steve Reder, head of wealth management, shares three easy strategies to pass your values to your heirs along with financial assets.

Watch now for his advice.

Crucial Financial Conversations

It’s only a matter of time before we must heed the call and help our aging parents manage their day-to-day lives. The challenge is real, complex and growing each year.

One way to approach this new relationship with your parents is to have a family meeting to discuss a path forward and create a plan for how wealth will transfer to the next generation.

For more than 30 years, the team at RWA has worked with hundreds of clients to discover shared values across generations and ensure that aging family members are financially comfortable and well cared for. Our conversations have ranged far beyond money and investing, encompassing emotionally charged topics like mortality as well as physical and social independence.

Since there’s no one-size-fits-all approach to this issue, we’ve outlined key steps to think about before, during and after that all-important first meeting. Address the following: finances, lifestyle, values, health care and legacy. As an adult child, it’s also a great opportunity to educate yourself on how the family’s wealth was built and how you can be a good steward.

If you feel uncomfortable raising the topic with your family, use this guide as an invitation for a more in-depth conversation with us about the responsibilities you expect to take on in the months and years ahead. Don’t hesitate to call us to find out how we can help you and your family with a meeting or a plan.

Whatever your approach, there’s no substitute for preparation.

Preparing for Your Family Meeting

Regardless of who is involved in the planning (you and your parents, you and your siblings, or you and others), identify your top priorities for the meeting ahead of time and place them on a formal agenda. And don’t worry—at the start of this process, it’s common to be unsure of what those goals are or should be. Your advisor can help you determine them.

Who is most likely to make the meeting a success? A belligerent sibling, for example, might not be the best person to invite to a first meeting. (On the other hand, they might take offense if omitted.) A family lawyer or financial advisor might also be a good choice if your aging family members are open to discussing financial or health-related affairs outside their closest relations. Our advisors have attended many such meetings at our clients’ request.

To be most productive, every meeting needs a leader to keep the conversation on track. The best choice will depend on family and personality dynamics. Pick the person that participants are most confident in and emotionally comfortable with. If you have a lawyer or advisor participating, they can provide guidance and make sure everyone is heard.

Are your parents comfortable revealing full financial details with all family members? If you anticipate a near-term change in lifestyle (such as downsizing a home, selling a car or hiring a care worker), you’ll need a more detailed picture of their finances. If you or they want to set boundaries on who knows what, it may make sense to have a private pre-meeting with whoever will be the financial point person and then speak in generalities at the larger gathering. Meetings can still be productive and valuable even without full disclosure since discussions and decisions encompass much more than just financial considerations.

Make an agenda and share it in advance so that everyone has time to prepare. Set a date and decide where to meet—depending on the size of your group, a family member’s house, an advisor’s office, a conference room at a hotel or a private room at a restaurant could work.

During the Meeting

Remind participants that you’re working together to be advocates for aging family members—not making their decisions for them. Is there a concern that must be addressed? Review the goals identified before the meeting. Are they achievable? What’s the expected timeline for this transition? You may wish to discuss your parents’ experience with their own parents—what worked, what didn’t, what would they have changed?

It isn’t enough for someone to simply agree to take notes. As important points come up, check in to be sure that they are being recorded.

As you move from one topic to the next, sum up with well-defined next steps. This will help keep the conversation focused. As you talk through the agenda and agree on follow-up items, make sure someone is assigned to handle each task. These tasks will form the basis of your family’s action plan. Your advisor can help with this.

This point person will be responsible for checking in and keeping everyone on track after the meeting.

After the Meeting

Following up on the action plan agreed upon at the meeting will smooth the transition into managing affairs and care. The plan should be a living document that is adjusted to your family’s needs and capabilities over time. Try to meet once a year to address any updates that need to be made. If someone experiences a health event, you may have to review this document and alter your action plan sooner.

Summarize the action plan created during the meeting, write it down, and mail or email it to all attendees as well as those who might have been scheduled or wanted to attend but couldn’t.

Review any outstanding responsibilities or items with the assigned partner or family member—and make sure all agree.

So long as everyone is comfortable sharing information on assets, go over all legal and financial documents (wills, trust documents, health care directives, powers of attorney, etc.). Is everything (account owners, beneficiaries, etc.) current and consistent or are updates required? Note that beneficiary designations on accounts supersede estate documents.

Make a safe storage plan for your family’s important records. Know where hard copies are kept so that you’ll be able to access them in case of emergency. As an RWA client, you have access to eMoney’s secure online document “vault” (speak to your advisor for help accessing this). Online accounts and passwords can be shared by using a secure application designed for the purpose.

Finally, ask yourself if you need to make any personal or professional changes to adapt to and accommodate this new responsibility. Is this an opportunity for the younger generation to get its financial or legal affairs in order?

We’re Here To Help

We know it’s a lot to take in, especially when dealing with what can be a complicated and emotional topic. One way around this is to start these meetings early to build strong lines of communication ahead of time. Parents might start discussions when their children are in their teens or college years. This can set the tone for financial responsibility as they begin earning their own money and building a career. It also gives your family more time to find alignment on values and a shared financial legacy.

We should note that our advice assumes that all are willing participants. Forcing the issue is unlikely to be productive, so if your parents say “no” to discussing these topics, we’d suggest letting some time pass before trying again. People who are new to the idea and are initially resistant may reconsider with time or a bit of gentle persuasion—or if health or life circumstances change for anyone in the family.

In the meantime, consider this guide a resource. If you have any questions about it, or if you’d like to know more about how RWA approaches family meetings, your investment needs or your financial planning goals, please ask your advisor.

Estate Planning

The 2017 Tax Cuts and Jobs Act (TCJA) nearly doubled the federal estate tax lifetime exemption from prior levels, but that provision will sunset this year if Congress doesn’t act to extend it. (For more on the TCJA sunset, click here.) While the federal exemption is making headlines, the rules in your state of residence could be a larger concern for you and your heirs if you live in a state that charges estate or inheritance taxes.

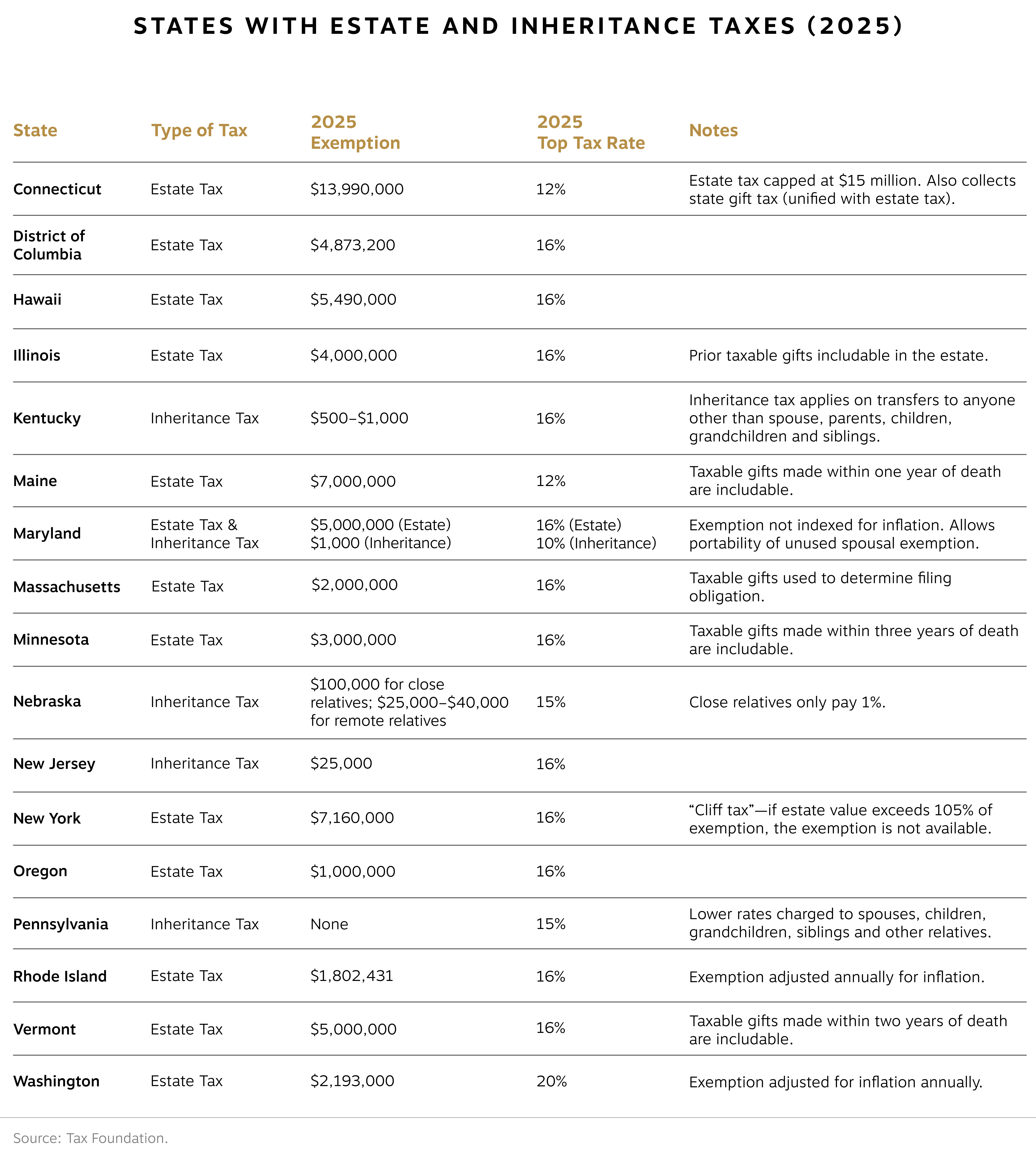

State-level estate and inheritance taxes often have lower exemption thresholds that catch you by surprise. Home equity, life insurance policies in your name and taxable portfolio assets can add up fast. This could significantly reduce what your heirs receive, even if your estate falls well below federal limits. As of tax-year 2025, 16 states and the District of Columbia have estate or inheritance taxes (see table below).

Understanding the Difference: Estate vs. Inheritance Taxes

Estate tax is levied on the deceased’s estate before assets are distributed. The estate itself pays the tax. This is imposed by the federal government and some states.

Inheritance tax is paid by the beneficiaries who receive the inheritance. Certain family members are often exempt or pay reduced rates. There is no federal inheritance tax.

Why State Estate and Inheritance Taxes Matter

These state-level taxes can have a significant impact for several reasons:

While the federal exemption is $13.99 million in 2025 (double that for married couples), individual state exemptions can be as low as $1 million. Note that unlike with federal taxes, a deceased spouse’s exemption does not transfer to the surviving spouse (known as portability) at the state level.

Owning property in a state that imposes these taxes can trigger liability even if you reside in an estate-tax-free state.

In states like Maryland, both estate and inheritance taxes may apply.

According to the Tax Policy Center, state and local governments collected $6.7 billion from these taxes in 2021, making them a sizable revenue source for the states that have them. In other words, states that charge them have a financial incentive to continue doing so.

How To Plan Strategically

Your state of domicile, or where you have your permanent home, determines which state’s estate tax laws apply. Moving to a state without these taxes can yield significant savings.

Key actions to establish domicile include:

States losing wealthy residents may aggressively audit domicile claims, so make sure your documents are in order to avoid complications down the road.

Beware of “clawback” provisions in states like New York, Maine and Minnesota, which can add back recent gifts to your taxable estate.

For married couples, special planning is important. At the federal level, if one spouse doesn’t use their full exemption, the surviving spouse can use what’s left (this is called portability). However, most states don’t allow this sharing between spouses—only Hawaii and Maryland do. For this reason, it can be a good idea to review how your assets as a married couple are titled and potentially transfer assets from one spouse to another to ensure the state estate tax exemption is utilized.

Some couples employ special trusts (called credit shelter trusts) to ensure both spouses fully use their state exemptions. Under current tax law, any money left inside the credit shelter trust after the second spouse’s passing will not be subject to estate taxes, so the goal is typically to leave it untouched for as long as possible. Some states also allow special arrangements (called QTIP elections) that can help married couples minimize both federal and state taxes.

When properly structured through an irrevocable life insurance trust (ILIT), life insurance proceeds can provide a source of funds to pay estate taxes without adding to the taxable estate.

This strategy is particularly valuable for:

Be Prepared

While federal estate tax affects relatively few Americans, state estate and inheritance taxes impact many more families with moderate wealth. With exemptions as low as $1 million in some states, even homeowners in high-value markets may face significant exposure based on the assessed value of their home.

If you live in or own property in a state that charges estate or inheritance taxes (or are considering moving to one), talk to your team so we can help you to consider this additional tax liability in your plan.

Archives

Never miss an issue

By providing your email address you consent to receive marketing content from RWA Wealth Partners, LLC.