Monthly

Newsletter

Will the Market Heat Wave Continue?

Third-Quarter Outlook

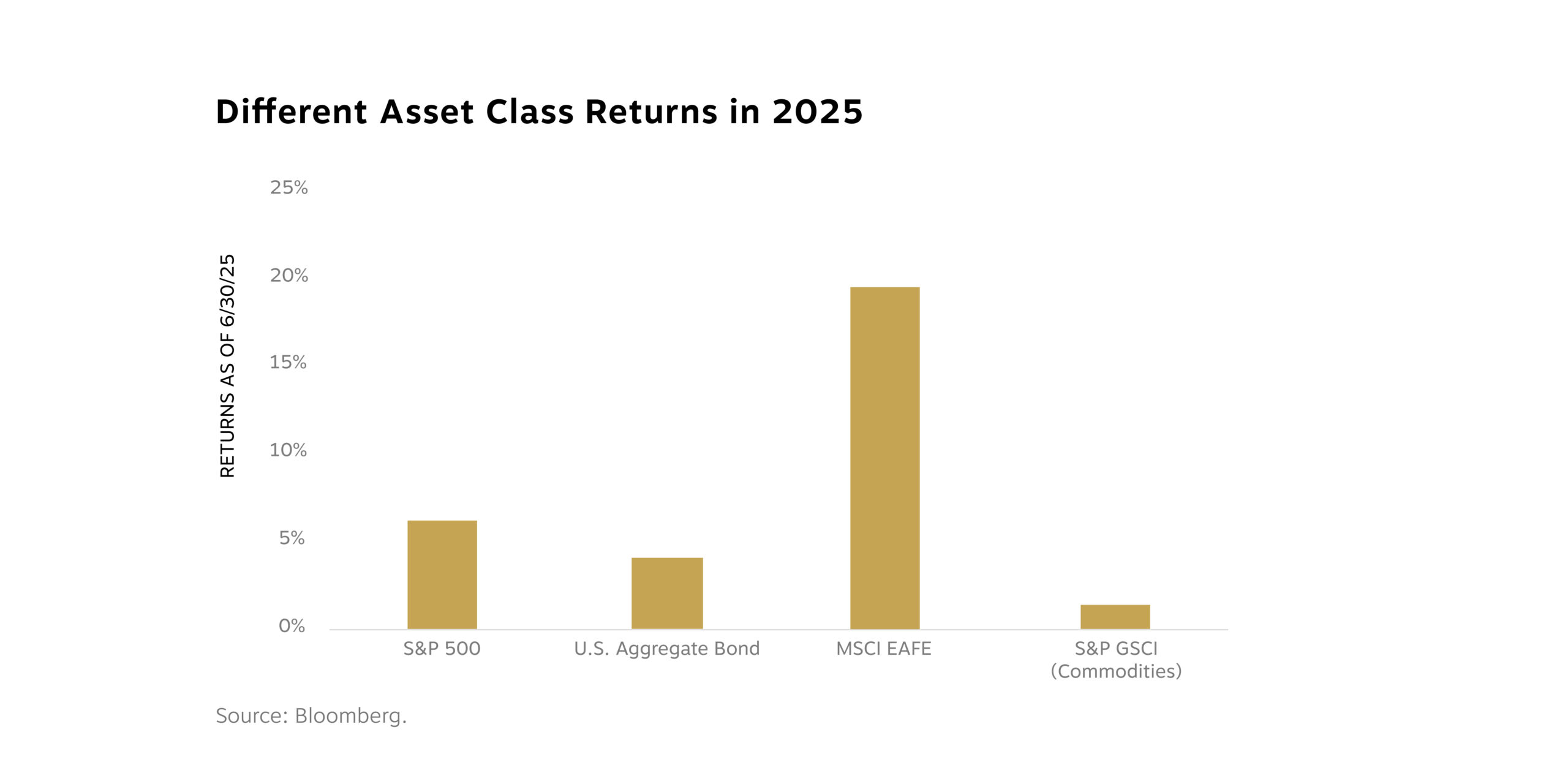

As we head into the second half of 2025, markets continue to buck expectations. The large-cap S&P 500 and tech-heavy NASDAQ both reached new all-time highs in June, capping off a strong first half of the year, and that momentum carried into July.

It’s been a welcome turnaround for investors. Just a few months ago, markets were down 20% in a matter of weeks as stalling trade talks and the potential disruption to AI infrastructure from DeepSeek rattled traders. But many of those concerns have been replaced with renewed optimism even as the tariff and AI stories continue to develop. Stocks have rallied in response, rewarding investors who stayed disciplined and focused on long-term outcomes. At the end of June, the S&P 500 index was up 6.2% year to date.

Bonds have been a stabilizing influence for diversified investors, returning 4.0% in 2025 through the second quarter. After a volatile stretch, longer-term yields have drifted lower as inflation hovers around 2.5% and the market grows more confident that the Federal Reserve may start cutting rates later this quarter.

Foreign stocks have been a highlight—particularly in developed economies. The MSCI EAFE index has more than tripled the return of U.S. stocks year to date with a 19.4% first-half gain. Valuations remain compelling, and economic momentum abroad is beginning to firm up.

On the other end of the spectrum, commodities have had lackluster results, gaining just 3.3% through Q2. While there was concern that new tariffs would cause rapid inflation and that conflict in the Middle East would cause the price of oil to spike, that hasn’t materialized in any meaningful way, yet. As a result, this area of the market remains under pressure.

Reasons for Market Resilience

So what’s driving this confidence in equities? In short, the health of the consumer. President Trump’s administration continues to dominate headlines, but behind the noise, we’ve seen resilience in the job market and inflation trending in the right direction over the last three years.

Unemployment declined to 4.1% in June, labor participation is steady and wage growth is cooling—but still positive. This dynamic supports consumer activity without fueling inflation. As goes the consumer, so typically goes the economy—when people have steady jobs, they tend to spend, creating a virtuous cycle for growth.

Inflation has stubbornly held above the Fed’s 2.0% target, but it’s been trending in the right direction for most of 2025. That said, some cracks may be forming. After months of gradual moves lower, June’s consumer price index showed headline inflation running at 2.7%, the highest in four months. Excluding food and energy prices, inflation showed a 2.9% annual pace. Driving the uptick were prices for goods that are more sensitive to a rise in tariffs—furniture, apparel, toys and appliances. These price increases accelerated at the end of the second quarter. This indicates at least some businesses are now passing on cost increases to the consumer, though one month does not a trend make.

For now, the combination of moderating inflation and strong employment has been a driving force behind stock market gains. We’ve worked to position your portfolios to participate when markets are rising and provide defense if they reverse course, and diversification is a key aspect of that discipline.

The Fiscal Outlook Caveat

That said, a longer-term theme may work against the economy: the fiscal outlook.

The nearly 900-page One Big Beautiful Bill Act signed into law on July 4 includes many new provisions but was centered around making permanent the cuts in the Tax Cuts and Jobs Act of 2017. (For more on what’s included and how you can benefit, please scroll down to the next story, What the One Big Beautiful Bill Means for You, Your Family and Your Wealth.)

While many of these tax policies are not entirely new, extending them avoids a jump in tax liability for higher earners that would have occurred had the policies expired as scheduled at the end of 2025. The law also includes significant cuts to social safety net programs and increases the budget to carry out Trump’s immigration agenda. Despite slashing spending in some areas, extending the tax cuts raises cost concerns for the U.S. budget.

The Congressional Budget Office estimates this law will add about $3.3 trillion to the federal deficit over the next decade. Some of that may be offset by additional growth or tariff revenues, but credit rating agencies have taken note, and we’re already seeing pressure on the long end of the Treasury curve as a result, pushing prices lower and yields higher.

Looking Ahead

With a dizzying array of narratives and market twists and turns already behind us, here are some of the key themes to watch over the second half of the year.

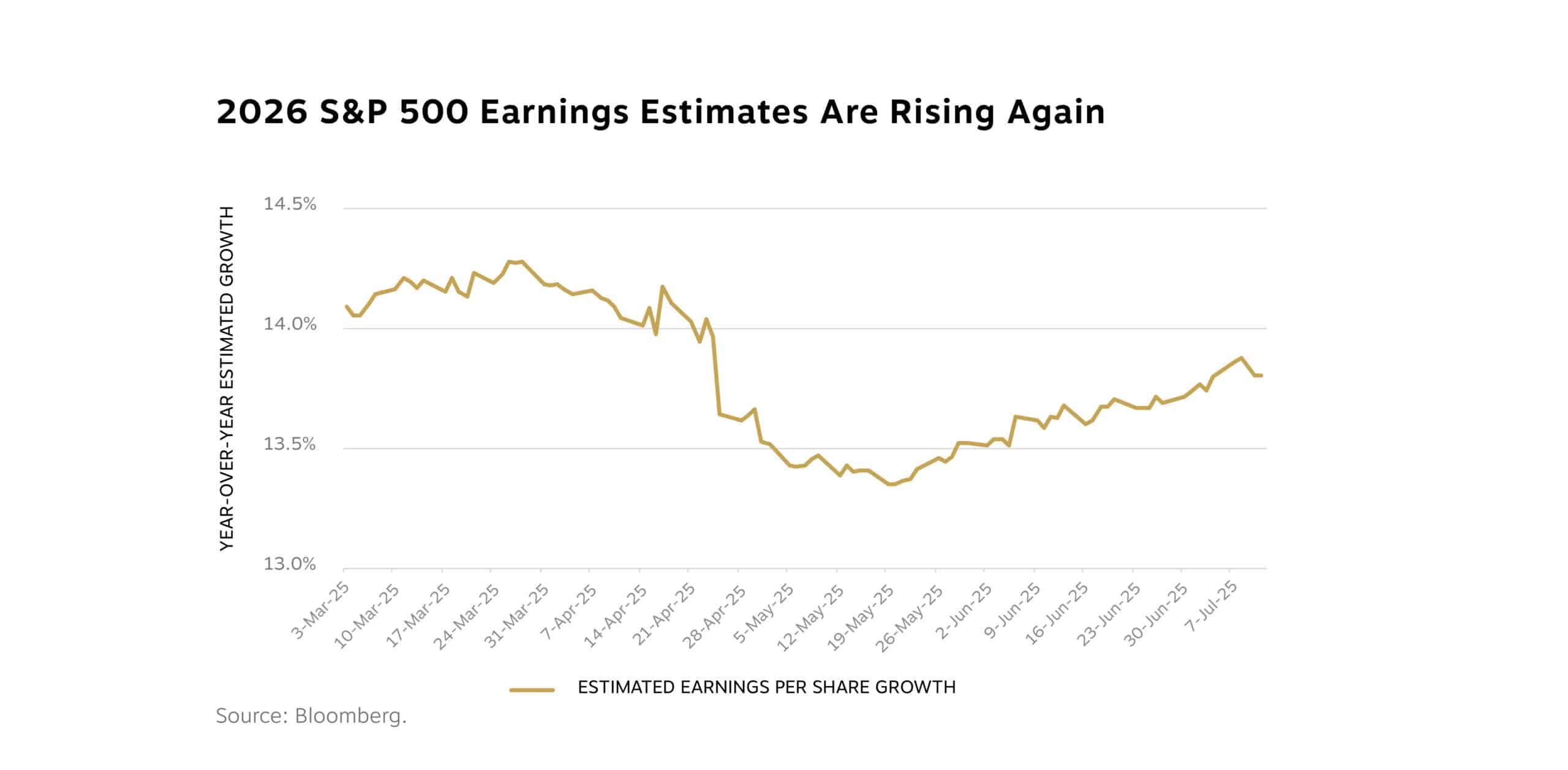

First, corporate earnings expectations have improved. Tariff concerns have been dialed back, and companies are adjusting as we expected they would, particularly larger companies with the resources and reach to do so. Analysts now project nearly 10% earnings growth for 2025, up from mid-single digits just a few months ago. That’s been a key driver of market gains. It’s early in the second-quarter earnings reporting season, but if current results hold, Q2 will mark eight consecutive quarters of year-over-year earnings growth for S&P 500 companies. And as you can see in this chart, expectations for growth are even better in 2026.

Second, the Federal Reserve is likely to adjust policy soon. While a July cut seems unlikely, we expect Chair Powell may use his Jackson Hole speech next month to signal a potential September move—assuming inflation does not creep any higher and economic growth remains steady. For now, the opportunity to benefit from higher rates on bonds remains intact. At current yields, investment-grade options across both corporate and municipal bonds offer compelling returns and can provide meaningful income and stability in a portfolio.

Finally, valuations could still present opportunity, particularly outside the U.S., as developed foreign markets remain attractively valued, with room for multiple expansion as fundamentals improve.

We believe we’re well positioned to face what comes, and we’re mindful of potential risks to the equity and bond markets. If you have any questions about your portfolio or plan, please contact your team.

Our Latest Videos & Media Appearances

Chief Investment Officer Joseph “JP” Powers recaps recent market and economic trends and discusses the themes he’s watching in the second half of 2025. Click here to watch now!

Diana Linn, partner and wealth advisor, shares her perspective on how we approach the financial aspects of divorce with clients. In a stressful time, having a trusted partner to answer questions and guide you through important decisions can provide welcome relief. Hear what Diana has to say.

CEO Michelle Knight was recently featured in Barron’s Advisor, where she talks about how she came to the financial industry, her perspective on leadership, the future for RWA and more. Read it here.

What the One Big Beautiful Bill Means for You, Your Family and Your Wealth

Tax Planning

The passage of the One Big Beautiful Bill Act (OBBB) ushers in sweeping changes to taxes that will frame legacy planning and wealth strategy for years to come. Signed into law on July 4, 2025, the OBBB not only makes permanent many of the provisions of the Tax Cuts and Jobs Act (TCJA) from 2017, but it also introduces new strategic opportunities to preserve and grow your wealth.

While not everyone will benefit or want to change their wealth plan as a result of the OBBB, many investors will have new options to save. Below is our analysis of what could be most consequential for you and your family.

Permanent Individual Rate Structure and Standard Deduction

- Income tax rates: Rates of 10%, 12%, 22%, 24%, 32%, 35% and 37% are now permanent and will be adjusted for inflation annually. This move averts the reversion to higher, pre-TCJA rates that was scheduled to hit after 2025.

- Standard deduction: This is permanently increased and indexed for inflation, with 2025 deductions set at $15,750 (single), $31,500 (joint) and $23,625 (head of household). Personal exemptions are gone for good.

- Alternative minimum tax (AMT): Exemption amounts and phaseouts are extended permanently, with key thresholds adjusted upward for higher earners.

State and Local Tax (SALT) Deduction Expansion With a Catch

- Deduction cap: The SALT deduction cap rises from $10,000 to $40,000 per household beginning in 2025. This cap increases 1% annually through 2029, then reverts to $10,000 in 2030.

- Income phaseouts: The $40,000 cap begins phasing down once modified adjusted gross income (MAGI) exceeds $500,000, reducing by 30% of the excess, but it does not phase down below the original $10,000 limit; $600,000 is where it fully phases down to $10,000.

- Planning nuances:

- Deduction includes state income, real estate and personal property taxes.

- There are no changes to pass-through entity tax workarounds.

- High-income taxpayers in states like California, New York and Massachusetts stand to benefit most.

Strategic Shifts in Credits and Charitable Giving

- Child tax credit: This is permanently increased to $2,200 per qualifying child, indexed to inflation, with unchanged phaseout thresholds: $200,000 (single) and $400,000 (joint).

- Child and dependent care credit: The limit is raised from 35% to 50% of qualifying costs, with phaseouts ensuring no credit falls below 35%.

- Above-the-line charitable deduction: From 2026, this is available for non-itemizers at $1,000 (single) or $2,000 (joint). For itemizers, only charitable donations above 0.5% of adjusted gross income (AGI) are deductible, and the value of itemized deductions is limited to 35% for those in the 37% bracket.

Senior and Family-Focused Opportunities

- Senior deduction: This is a temporary (2025–2028) additional $6,000 (single) or $12,000 (joint) deduction for taxpayers 65 and older. It phases out at $75,000 (single) and $150,000 (joint) modified AGI.

- 529 plan enhancements:

- Starting in 2026, qualified education expenses expand to include K–12 tutoring, homeschooling, workforce training and special needs therapies.

- K–12 tuition withdrawal limit climbs from $10,000 to $20,000 per year.

- Trump child savings accounts:

- For children under 18 (or under 8, depending on the provision), parents and family may contribute up to $5,000 post-tax per year, indexed for inflation.

- No distributions are allowed until the calendar year in which the child turns 18.

- Investment is limited to broad U.S. stock index funds; withdrawals follow graduated age milestones, with tax treatment varying by use and timing.

Estate, Gift and Business Owner Tax Provisions

- Estate and gift tax exemption: From 2026 onward, this will be permanently set at $15 million (single) and $30 million (joint), indexed for inflation. This will prevent a sharp drop-off after 2025 and support multigenerational transfer strategies.

- Qualified business income (QBI) deduction: The 20% deduction for pass-through entities is now permanent, with phaseouts for professional service income at $75,000 (single) and $150,000 (joint).

- Miscellaneous deductions: Many itemized deductions previously subject to the 2% AGI limitation (e.g., investment management, tax preparation, unreimbursed business expenses) remain disallowed.

Specialized Deductions and Phaseouts

- No tax on tips and overtime: For 2025–2028, above-the-line deductions for up to $25,000 in tips and $12,500 ($25,000 joint) in overtime will apply, phasing out for high earners.

- Car loan interest: This is deductible up to $10,000 per year (2025–2028) for new vehicles assembled in the U.S., with strict income phaseouts.

- Mortgage interest: The $750,000 principal cap for deductible interest is made permanent. Home equity loan interest generally remains deductible for home improvement expenses.

Other Key Changes Impacting Wealth Planning

- Qualified Opportunity Zone (QOZ) program: This is indefinitely extended, with new tranches of QOZs to be designated every 10 years, creating planning opportunities for capital gains management.

- Clean energy and electric vehicle credits: Most residential clean energy credits, including those for solar, heat pumps and EVs, sunset in 2025. The EV credit expires on Sept. 30 and the home energy credit expires on Dec. 31. A few commercial clean energy incentives remain.

- Pease limitation removal, but new cap: While the Pease limitation (AGI-based reduction of itemized deductions) is gone for good, high earners face a 35% cap on the marginal tax benefit of itemizations.

- 529 plan and QOZ expansion: This permits additional uses and higher contribution limits for future-facing educational and impact investments.

Five Key Planning Imperatives

Just as transformative reforms like both of the SECURE Acts have changed the landscape of financial and retirement strategy, the OBBB challenges high-net-worth families to think differently and act intentionally.

We’ve identified five priority action items, each crafted to align with your goals, maximize opportunity and help steward wealth across generations.

- Gather Tax Returns and Run Scenario Modeling

It helps to start with clarity. Your team can help you analyze recent tax filings—ideally your 2024 return—and we can show you a scenario analysis of your plan updated for the OBBB. Here are a few of the big topics to focus on:

- Examine the new law’s provisions for 2025 and beyond, adjusting inputs for the latest rates, deductions and credits that may benefit you.

- Evaluate the changing SALT landscape, senior deduction eligibility, and the impact of family credits and overtime/tip tax exclusions.

- Test strategies for income smoothing, such as Roth conversions or timing large capital gains.

- Elevate Family-Centric Planning

The OBBB’s provisions for families create new possibilities for optimizing outcomes across generations. We can help you take advantage of this opportunity. These are steps you might take, depending on your situation:

- Update your eligibility for expanded child tax and dependent care credits as family circumstances change.

- Identify senior deduction candidates and optimize income levels to maximize benefits.

- Weigh the merits of Trump child retirement accounts versus enhanced 529 plans, factoring in flexibility, timing and family objectives.

- Enhance Planning for Business Owners

For entrepreneurs and business families, permanent QBI rules and phaseout thresholds demand a tailored approach. You might find these options helpful:

- Review QBI status and SSTB classifications to lock in qualified business income deductions.

- Time large purchases, incorporating accelerated depreciation or bonus depreciation strategies wherever advantageous.

- Integrate planning that considers SALT adjustments, business deductions and their combined effects on after-tax results.

- Strengthen Estate and Gift Plans

With higher and inflation-adjusted exemptions now permanent, it’s time to reexamine legacy strategies. Here’s how we can potentially help:

- We can help with estate plan alignment by verifying that trusts, entities and gifting strategies reflect the new $15M/$30M exemption levels.

- We can facilitate dialogue across generations on wealth transfer, helping your family prepare for responsible stewardship and philanthropic aspirations.

- We’ll actively reach out to clients surpassing new asset thresholds, offering bespoke solutions attuned to both opportunity and risk.

- Maximize 529 Plan Utility in Educational Planning

The newly expanded scope for 529 plans increases their relevance in comprehensive family planning. Here are a few considerations:

- Update withdrawal strategies for K–12 expenses. Families can now access up to $20,000 annually per beneficiary.

- Take advantage of new eligibility rules, including homeschooling, therapies, credentialing and more.

- Implement integrated funding plans, balancing enhanced 529 flexibility with the new Trump child accounts to coordinate benefits and tax treatments.

Start the Conversation Now

We recommend getting started on the action items above sooner than later. We are ready to walk you through simulations, recommend personalized strategies and ensure that every move serves to reinforce your financial legacy. And it’s all anchored by the values and goals that matter most to you and your family.

As always, your RWA team is here to steward you through these new legislative contours, ensuring your wealth remains a source of opportunity and resilience for generations to come. Contact your advisor if you have questions on the OBBB or believe you’d benefit from any of our recommendations.

The Art of Asset Location

Advanced Financial Planning Strategy

Location, location, location—a rule of thumb in real estate has applications in the financial planning world too. With expected returns for fixed income higher than in years past, proper asset location is as relevant as it’s ever been.

So, what do we mean by “asset location”? In essence, it means placing investment types (stocks and bonds) within account types (taxable, IRAs, Roths) to reduce the drag taxes can have on your investment returns over time. The concept is simple, though the execution can be complicated.

How Does Asset Location Work?

The principle is straightforward: Locate less tax-efficient investments in IRAs and Roths and more tax-efficient ones in taxable accounts. You have flexibility in where you place low-return investments since there’s lower tax liability when you sell the position or while you hold the position.

If we were to oversimplify the art of asset location, it might go like this: Bonds should be held in tax-deferred accounts, and stocks in taxable ones. That’s because stocks are typically taxed at lower long-term capital gains rates, while the income from bonds faces higher ordinary income rates (municipal bonds can be a notable exception here due to their favorable federal or state tax treatment).

Four Asset Location Scenarios

Typically, the following four contexts are where you’ll see the greatest advantage when implementing an asset location strategy:

- You’re in a high tax bracket (32% and up). The higher your current tax rate, the bigger the potential benefits of proper asset location.

- You have or expect to have substantial assets in all three tax categories: taxable, IRAs (tax-deferred) and Roths (tax-free).

- You invest substantially in fixed income. Generally, the more you invest in bonds and fixed-income securities, the more you can benefit from asset location.

- You expect to have a large difference between your current and future tax brackets.

A last thought to consider: The tax tail shouldn’t wag the investment dog. In other words, if carrying out an asset location strategy will result in a large tax bill and negate the benefits of the exercise, we won’t recommend it. For example, selling highly appreciated assets inside of a taxable account just to move those assets to their “proper” location could cost you as much or more in taxes than it would save.

Likewise, always consider the psychological or emotional impact of your asset location strategy. Despite the potential benefits of keeping volatile stocks in taxable accounts, you might feel more comfortable locating them in retirement accounts, where you are taking withdrawals over a longer period of time. Similarly, you may want to keep cash and bonds in taxable accounts that can provide a liquidity cushion in the event of unexpected expenses.

Asset location isn’t right for everybody, and your tax mileage will vary depending on your individual situation. But with the passage of the One Big Beautiful Bill Act and the opportunities it presents for tax savings, having a conversation about asset location now could help you enhance your long-term financial plan.

The information set forth in this communication is presented by RWA Wealth Partners, LLC (“RWA”). The contents are for informational and educational purposes only and are not intended as investment, legal or tax advice. Please consult with your investment, legal or tax advisor concerning any specific questions you may have. Past results are not indicative of future performance. The historical return of markets generally and of individual asset classes or individual securities may not be an accurate predictor of future returns of those markets, asset classes or individual securities. RWA does not guarantee the accuracy and completeness of any sourced data in this communication.

The information set forth in this communication is presented by RWA Wealth Partners, LLC (“RWA Wealth Partners”). The contents are for informational and educational purposes only and are not intended as investment, legal or tax advice. Please consult with your investment, legal or tax advisor concerning any specific questions you may have. Past results are not indicative of future performance. The historical return of markets generally and of individual asset classes or individual securities may not be an accurate predictor of future returns of those markets, asset classes or individual securities. RWA Wealth Partners does not guarantee the accuracy and completeness of any sourced data in this communication.

By providing your email address you consent to receive marketing content from RWA Wealth Partners, LLC.