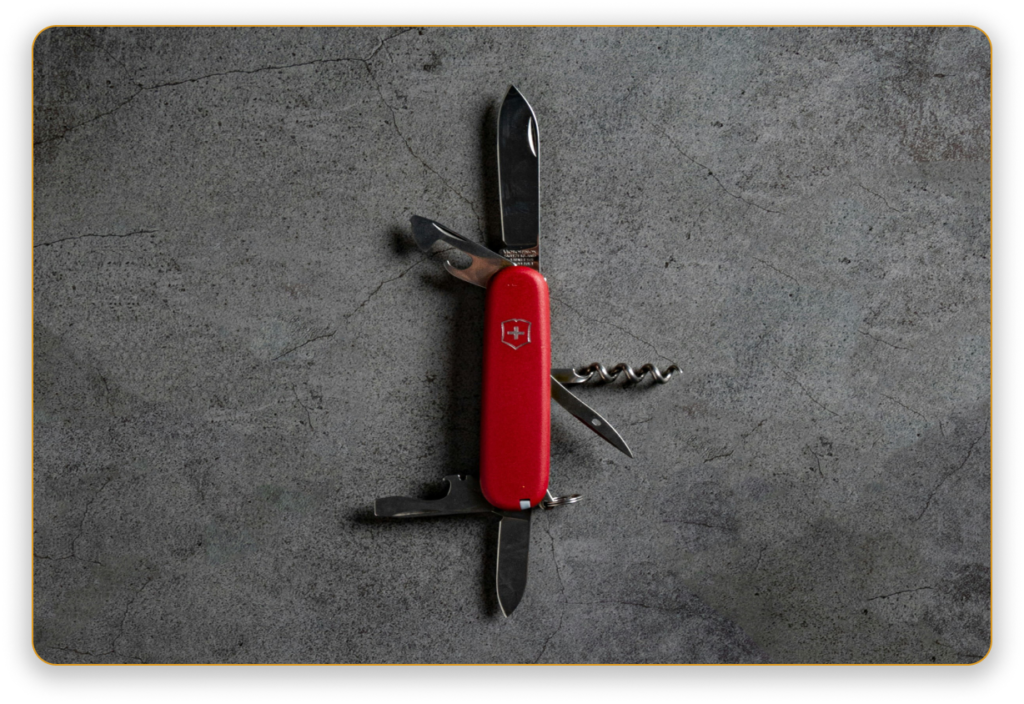

Think of trusts as the Swiss Army knife of financial and estate planning. With their adaptability and wide range of structures, trusts can cater to a variety of financial needs. Whether you want to avoid probate, reduce your tax liabilities, guard your assets from potential claims, set guardrails around large monetary gifts, or facilitate the efficient transfer of wealth to future generations, trusts are often the most attractive solution.

Despite their many advantages, trusts rarely receive the credit or attention they deserve in financial planning. According to a recent survey from Caring.com,1 over half of the wealthiest Americans have implemented no form of estate plan—no will, trust or advance directive. A staggering 54% attribute their inaction to procrastination.

However, delaying these decisions can come at a steep cost. Americans spend $2 billion annually on probate,2 a legal process that you can often avoid with proper trust planning. Trusts preserve the value of your legacy and allow for the private and streamlined distribution of your assets. In addition, using trusts to gift money during your lifetime can help you save money on estate taxes (up to millions of dollars for a large estate) while retaining your desired level of control.

We believe trusts are one of the most undervalued financial instruments for managing your wealth. Here we look at eight different trusts and how you can tailor them to meet your distinct wealth goals and aspirations.

Personal tax rates are probably going in one direction: Up.

Sources:

1. S&P: Macrotrends. (n.d.). S&P 500 index – 90 year historical chart.

Mitchell, C. (2024, January 8). Historical average stock market returns for S&P 500 (5-year to 150-year averages). TradeThatSwing.

2. Private Equity: Jahn, M. (2022, July 10). How do returns on private equity compare to other investment returns? Investopedia.

3. Private Credit: Kennedy, T., Seter, C., Serpe, J., & Cascio, R. (2023, September 12). Can private credit continue to perform? J.P. Morgan.

4. Real Estate Investment Trusts: Nareit. (n.d.). Annual index values & returns.

5. Hedge Funds: Perry, M. J. (2021, January 7). The SP 500 index out-performed hedge funds over the last 10 years. And it wasn’t even close. AEI.

Uhlfelder, E. (2022, July 25). The most consistently profitable hedge funds continue to prove their edge. RIA Intel.

6. Art: Heriot, A. (2023, May 31). Is art a good investment? The Fine Art Group.

Navigating Trust Structures: A Strategic Framework for Asset Management

As legal entities created to manage assets, trusts are a fiduciary arrangement where one party, the trustee, holds legal title to property for the benefit of another, the beneficiary. Formation of a trust begins with the grantor, the person who creates the trust to manage their wealth. The grantor transfers legal ownership of their assets to the trust, which is then administered by the trustee. The trustee’s role is to manage these assets in the best interests of the beneficiaries, who will ultimately receive the trust’s assets or income based on the terms specified by the grantor.

Different types for different needs

We design trusts with flexibility in mind so that they can help you in a variety of scenarios. Each type of trust serves a distinct function, whether it’s to provide for future generations, support charitable causes or manage tax obligations. The design of each trust reflects a careful consideration of your situation and financial planning objectives.

Control and management of assets

You get flexibility thanks to the different types of trusts that are available. You might set up a trust to keep control over your assets while benefiting from the trust’s protection. Or you might transfer control entirely to the trustee, providing a clear separation between you and the person or entity managing the assets. This distinction can affect factors such as your tax obligations or your level of protection from creditors.

Distribution and use of assets

One of the most critical functions of a trust is defining the terms of asset distribution. Trusts can stipulate not only who gets what but also when and how they receive these assets. This direction can help to honor your vision for your legacy, whether it be to provide a secure financial future for your children, contribute to philanthropic efforts or otherwise distribute your wealth. The conditions for distribution can be as varied and specific as you wish, providing a custom approach to estate planning.

Revocable vs. Irrevocable Trusts

There are two foundational types of trusts to be aware of: Revocable and irrevocable. A revocable trust allows you the flexibility to change the trust’s terms and beneficiaries as your personal circumstances change. In contrast, once you set up an irrevocable trust, its terms can’t be changed; its distribution of assets and the tax and protection strategies associated with the trust are final.

When deciding between a revocable trust and an irrevocable trust, you’ll need to weigh the flexibility and control offered by the revocable structure against the potential tax advantages and asset protection features of an irrevocable trust. (Note that while a revocable trust provides more flexibility, it generally becomes irrevocable upon the grantor’s death,3 and at that time the asset distribution plans set forth during their lifetime are finalized.)

A revocable trust may suit someone like a widow with significant assets who wants to keep a hand in managing her financial legacy. Her priorities may center on adaptability, with the added benefit of avoiding the probate process. In contrast, a CEO with a high net worth and potential exposure to creditors might opt for an irrevocable trust. This move would place a portion of her personal wealth outside of her estate with the goal of reducing personal risk and taxes.

Next, we’ll cover eight trust structures that can be highly valuable in managing your wealth or planning for your estate.

1. Stated Age or Conditional Gifting Trusts

A stated age or tiered payout trust4 provides financial support for your child throughout their life and distributes some or all assets to them outright at set ages or milestones. For example, you could set up a stated age trust to distribute 25% of the trust value at age 25, 50% at 30 and 100% at 35. These are conditional gifts.

Strategic advantages

A stated age trust balances control of the inheritance with gradually increasing autonomy for your child as they gain life experience. It sets guardrails around when your child will have outright access to trust assets based on their level of maturity and responsibility. The trustee manages the assets on your child’s behalf until the predetermined distribution ages, providing a level of oversight and protection during your child’s formative years. In addition, you can reward certain educational or career milestones by tying trust distributions to their achievement. For example, you may provide an additional disbursement upon college graduation to support your child’s burgeoning independence.

Trust terms

You can set up trusts with tiered payout rules as revocable or irrevocable. Whether a trust distributes assets when a beneficiary reaches a certain age, and what that age is, will depend on the specific conditions of the trust, which you will define when you create it.

Practical application

Let’s say you have a 22-year-old daughter who just graduated from college. You want to provide some financial assistance to help start her adult life and career. You also want to give a portion of your wealth today to take advantage of the elevated estate tax exemption, which as of 2023 reached $12.92 million5 per individual. However, given your daughter’s young age, you also want to protect your wealth and release it gradually as she matures.

You might create a trust that distributes 25% of assets at age 30, 50% at age 35 and the full balance at age 40. This structure provides your daughter increasing control of the inheritance in measured steps as she becomes more established in adulthood.

2. Lifetime Asset Protection Trusts (LAPTs)

An LAPT benefits your child throughout their life while keeping assets protected in trust. Your child never takes outright ownership of the assets.

Strategic advantages

When you place assets in an LAPT, you protect them against claims from creditors, lawsuits, divorces and other legal challenges. This helps safeguard your child’s inheritance, which is critical: Statistics show there’s a 90% chance6 that family wealth will be depleted by the third generation. For children who may not have strong financial management skills, a lifetime trust can be a strategic tool that places the management of inherited funds under the stewardship of a professional trustee.

This arrangement allows your child to benefit from the trust’s provisions while the principal assets are maintained for long-term growth and stability. You can tailor the trust to permit withdrawals for significant expenses, such as home purchases or business investments, subject to trustee approval.

Practical application

Let’s say you have a daughter who has displayed financial irresponsibility in her adult years. She struggles with budgeting, saves little for the future and spends frivolously on luxury items. While you want to provide an inheritance to help supplement her modest career earnings, you worry she may quickly lose the money if given full control.

In this scenario, you could establish a lifetime asset protection trust for your daughter’s benefit. The trust terms may allow for regular income distributions to help cover her living expenses. However, the bulk of the trust assets remain protected under professional trusteeship to preserve her core inheritance.

This lifetime trust structure allows your daughter to receive supplemental support from the trust while insulating the principal assets from her poor spending habits. The trustee oversight provides protection so your inheritance gift can responsibly aid your daughter without becoming depleted through misuse.

Social Security provides a continuous income stream in retirement, and the dependable monthly payments might help you cover certain routine expenses or health care premiums. However, your Social Security might represent just a fraction of your expected retirement income. Multiple income sources can push you into a higher tax bracket if not managed carefully, so it’s essential to claim your Social Security strategically to mitigate potential tax implications.

3. Charitable Trusts

For a trust to be considered charitable, it must serve specific purposes recognized as charitable under the law.7 These purposes traditionally include:

- Relief of poverty: Trusts created to help the impoverished or to provide opportunities for them to improve their circumstances

- Advancement of education: Trusts that support educational institutions, scholarships or educational programs

- Advancement of religion: Trusts established to support religious institutions or promote religious activities

- Promotion of health: Trusts dedicated to medical research, supporting hospitals, or providing care for the sick and injured

- Governmental or municipal purposes: Trusts that support public services or government functions

- Other purposes beneficial to the community: Trusts that may support a wide range of activities known to improve the community’s well-being, such as arts programs or environmental conservation

There are two main types of charitable trusts: Charitable lead trusts (CLTs) and charitable remainder trusts (CRTs). A CLT provides a stream of income to a chosen charity for a set period, after which the remaining assets revert to the trust’s beneficiaries. Conversely, a CRT allows you to receive regular payments during your lifetime, with the remaining value of the trust property going to a charity after a specified period.

Strategic advantages

Incorporating charitable trusts into your estate planning can serve the dual purpose of fulfilling charitable goals and managing tax liability. Charitable trusts can offer substantial tax benefits, such as deductions on income taxes and potential savings on estate and gift taxes. They can also provide an additional source of income, which may be advantageous in your retirement years.

Charitable deduction limits

Currently, the IRS permits a deduction of up to 60% of adjusted gross income (AGI) for charitable contributions8 made through certain types of trusts, which can significantly lower your tax burden. It’s expected that this threshold will revert to 50% of AGI with the sunset of the Tax Cuts and Jobs Act at the end of 2025.

Balancing charity and family support

When establishing charitable trusts, it’s helpful to set goals early on for how much of your wealth you want to pass on to your children and what portion should go to philanthropy. You can think of this as a dollar figure or as a percentage of your wealth.

Interest-rate considerations

Interest rates influence the appeal of CRTs or CLTs in different economic cycles. CRTs are more attractive in high-interest environments. The value of the income stream that the non-charitable beneficiary receives from a CRT is calculated using an IRS-approved interest rate, which is often influenced by the prevailing market interest rates. CLTs, on the other hand, shine in low-interest scenarios. They aim to transfer wealth efficiently, as they allow excess earnings above the IRS’ specific rate to pass to beneficiaries tax-free.

Proactive estate tax reduction

Charitable trusts can help you strategically manage your estate taxes upstream and extend your support to causes you care about. With the current elevated lifetime gift tax exemption, you can allocate your assets in a way that could minimize your taxable estate. With proactive gifting through trusts, you can preserve more of your estate for future use and enjoyment by your family.

Practical application

Let’s say you have a $15 million estate that you want to pass on to your children. With the 2023 estate tax exemption of $12.92 million, you’re concerned about the 40% tax that would apply to the amount over the exemption, which in this case is $2.08 million.

To reduce your estate tax liability, you set up a CRT and place $3 million in it. The trust specifies that a charity of your choice will receive the rest after you and your wife pass away. During your lifetimes, you will receive annual payments from the trust equal to 5% of the initial funding amount, or $150,000 per year.

By moving $3 million into the charitable trust, you have reduced your taxable estate to $12 million. This amount is now under the estate tax exemption limit. The charitable trust allows you to avoid estate taxes while providing income today and supporting your chosen charity in the future.

4. Irrevocable Life Insurance Trusts (ILITs) & Crummey Provisions

An ILIT is an irrevocable trust specifically designed to own your life insurance policy, removing the policy’s proceeds from your estate for tax purposes. This separation helps to maintain the estate’s value and shield your beneficiaries from the tax responsibilities that typically accompany life insurance proceeds.

Crummey powers

Crummey provisions are an essential feature of ILITs. They allow the trust to receive gifts that qualify for the annual gift tax exclusion. This means that you can make yearly contributions to the ILIT within the gift tax exclusion limits ($17,000 per child in 2023, or $34,000 per child if you’re married filing jointly9), which helps fund the life insurance policy without incurring a taxable event. To comply with gift tax exclusion rules, it is required that beneficiaries be notified of their right to withdraw the contribution for a specific period each year.

Strategic advantages

The primary purpose of an ILIT with Crummey powers is to prevent the substantial proceeds of life insurance policies from becoming taxable as part of your estate. This ensures that your beneficiaries can benefit from the full amount of the life insurance without the burden of taxes. Since life insurance proceeds usually pay out quickly, an ILIT provides your estate with immediate liquidity that can cover expenses such as debts, taxes and other administrative costs without the need to sell other assets.

Additional benefits

For business owners, an ILIT can provide the funds necessary to pay estate taxes related to the business without disrupting operations or creating financial strain. You can also use ILIT funds to ensure specific financial goals for beneficiaries are met, like funding education or providing special needs care.10

Practical application

Let’s say you want to support your children financially without increasing the size of your taxable estate. You might set up an ILIT and use Crummey provisions to make annual gifts to the trust. These gifts are used to pay the life insurance premiums, ensuring that the policy remains active. When you pass away, the insurance policy pays out to the ILIT, which then provides for your children as per the trust’s instructions—free from estate taxes and without affecting your lifetime exemption limit.

5. Generation-Skipping Trusts (GSTs)

A GST allows you to pass wealth directly to your grandchildren, bypassing your children’s generation. This strategic structure helps minimize estate taxes that could accrue when transferring wealth across multiple generations.

Strategic advantages

The key benefit of a GST is avoiding estate taxes when assets ultimately pass to your grandchildren. By skipping your children’s generation, you save on taxes that would apply when wealth transfers first from you to your children and then again from your children to your grandchildren. Any asset growth that occurs inside the GST is also removed from your taxable estate.11

Generation-skipping transfer tax (GSTT)

The GSTT is a tax on transfers to individuals who are at least 37.5 years younger than the donor, and it’s designed to prevent the avoidance of estate taxes. This tax rate is 40%12 and is in addition to any gift or estate taxes owed. The GST tax exemption is unified with the federal gift and estate tax lifetime exemption, drawing from the same collective exclusion amount of $12.92 million per individual in 2023. Unlike the federal estate tax exemption, any GST exemption unused at one spouse’s death13 cannot be used by the surviving spouse.

Assessing family needs

Before establishing a generation-skipping trust, consider the immediate and future financial needs of both your children and grandchildren. Hold a family meeting to align the trust with your family’s broader financial goals. By communicating openly and planning comprehensively, you can use the trust to responsibly support grandchildren without undermining your children’s finances.

Practical application

Let’s say you’re a grandparent who wishes to support your grandchildren’s education. By creating a GST, you can allocate funds specifically for this purpose and protect the resources from estate taxes at the parents’ level. This not only fulfills your educational goals for your grandchildren but also provides a tax-efficient way to transfer wealth.

6. Asset Protection Trusts (APTs)

APTs legally isolate an individual’s assets to shield them from future creditors. When you transfer property into an APT, these assets become owned by the trust rather than you. As a result, the assets are generally beyond the reach of creditors (if the trust meets specific legal conditions).

Strategic advantages

APTs shield an individual’s wealth, securing assets so that you can pass them on to beneficiaries without the risk of creditor claims or lawsuits. This is especially important for professionals in high-risk fields or businesses in which the potential for future litigation may be higher.

Jurisdictional variance

Not all U.S. states recognize the legitimacy of APTs, and laws vary significantly from one jurisdiction to another.14 Some states offer more favorable trust laws for asset protection, while others may not support APT structures at all. Talk to your advisor about whether APTs are available where you live.

Timing of establishment

For an APT to be effective, you need to set it up when there are no pending or foreseeable creditor claims. Assets transferred into the trust after such claims arise may not be protected and can be subject to legal challenge.

Practical application

Let’s say you’re a surgeon, and you face a higher risk of malpractice lawsuits because of the complex nature of your work. To protect your assets, you establish an APT and transfer ownership of several rental properties into the trust. By doing this, you aim to shield these valuable real estate investments from any potential legal judgments down the road. If you get sued for malpractice, the plaintiff could not seize your rental income or the properties themselves since they are now owned by the APT.

7. Grantor Retained Annuity Trusts (GRATs)

A GRAT is an irrevocable trust designed to shift future asset appreciation to beneficiaries, typically children, with minimal gift and estate tax liability. The grantor contributes assets into the GRAT and in return receives a series of annual payments for a specified term.

Because you as the grantor retain an income interest, the value of the taxable gift that funds the GRAT is discounted. A properly designed “zeroed-out” GRAT allows you to transfer upside appreciation in excess of the annuity payments without using your lifetime exemption amount or incurring gift taxes.

Strategic advantages

GRATs are an appealing solution for high-growth assets since they allow the grantor to freeze the value of these assets for tax purposes at the time of transfer. The value of the annuity payments made to the grantor is calculated using an IRS-prescribed interest rate known as the Section 752015 rate. If the trust’s growth rate exceeds this IRS rate, the surplus growth can be passed on to the trust’s beneficiaries free of any additional gift tax.

Interest-rate considerations

The IRS Section 7520 rate serves as the GRAT’s hurdle rate and is based on current interest rates. So, the effectiveness of a GRAT depends heavily on prevailing interest rates at the time it is established. Look at the table below. The lower the 7520 rate, the lower the annuity payments to the grantor. Lower annuity payments mean more of the assets and their appreciation can potentially remain in the GRAT to pass on to beneficiaries.

Think of the current estate tax breaks as a limited-time offer.

The current tax code has an expiration date, and the sunset is approaching faster than a filibuster in a contentious Senate debate.

| Valuation Month | Section 7520 Interest Rates |

|---|---|

| January 2023 | 4.6 |

| February 2023 | 4.6 |

| March 2023 | 4.4 |

| April 2023 | 5 |

| May 2023 | 4.4 |

| June 2023 | 4.2 |

| July 2023 | 4.6 |

| August 2023 | 5 |

| September 2023 | 5 |

| October 2023 | 5.4 |

| November 2023 | 5.6 |

Source: IRS.gov

For example, if the 7520 rate is 3% when the GRAT is funded, the annuity payments will be calculated using 3% as the return assumption. If the assets then appreciate at 5%, the excess growth over the 3% hurdle can transfer tax-free to beneficiaries when the GRAT terminates. But if the 7520 rate is higher, say 6%, the required annuity payments will be larger, leaving less potential excess appreciation to transfer.

Practical application

Let’s say you’re a successful entrepreneur with a substantial estate, and you wish to transfer your wealth to your children without a hefty tax bill. You set up a GRAT and transfer shares of your company into the trust. The GRAT will pay you an annuity over a set period. Any increase in the value of the shares over the IRS interest rate passes to your family tax-free, allowing you to reduce your estate taxes while still receiving income.

8. Intentionally Defective Grantor Trusts (IDGTs)

IDGTs are irrevocable trusts that allow you to remove assets from your taxable estate. When you transfer assets to an IDGT, you no longer control or benefit from them directly. However, you deliberately structure the IDGT so you remain responsible for paying income taxes on any earnings generated by the trust assets.

Strategic advantages

The IDGT allows you to freeze the value of assets for estate tax purposes while still absorbing the income tax burden during your lifetime. By paying the income taxes on the IDGT assets, you are making an additional tax-free gift to the trust each year.

Note: In September 2023, the IRS issued guidance indicating that it is challenging a basis step-up treatment for assets in IDGTs16 when the grantor dies. The tax impact remains uncertain, as the courts may ultimately decide this issue. Talk to your advisor about the potential effects of this ruling if you settled an IDGT or are planning to create one.

GRATs vs. IDGTs

GRATs and IDGTs are similar trusts that can help you efficiently transfer income-producing assets. When evaluating your options, think of a GRAT as a way to lend your assets to a trust and get them back with interest, with the hope of passing on extra earnings tax-free. On the other hand, the core function of an IDGT is to pay taxes on your assets now so your family can receive them without the tax hit later, maximizing what you pass on.

Practical application

Let’s say you transfer $1 million in stocks to an IDGT, and the stocks appreciate to $5 million over 10 years. You’ve removed $4 million in appreciation from your estate. Plus, if you paid $100,000 in income taxes on the IDGT earnings over those 10 years, you’ve made another $100,000 tax-free gift on top of it. This compounding effect can increase the wealth you pass down.

| Trust Type | Primay Purpose |

|---|---|

| Revocable Trust | Avoid probate, retain control |

| Irrevocable Trust | Provide tax advantages, protect from creditors |

| Conditional Gifting Trust | Set guardrails around gifts |

| LAPT | Preserve generational wealth |

| Charitable Trust | Reduce taxes, engage in philanthropy |

| ILIT | Avoid estate tax on life insurance |

| Generation-Skipping Trust | Minimize estate taxes for grandchildren |

| Asset Protection Trust | Shield assets from creditors |

| GRAT | Freeze value of estate for reduced taxes |

| IDGT | Pay income taxes upstream |

Trusts as a Core Pillar of Wealth Management

Trusts remain one of the most versatile tools for managing and preserving your wealth. These financial instruments can help you dramatically reduce estate taxes, responsibly gift assets to family, fund your philanthropic initiatives and protect your wealth from external threats. However, we often see clients neglect these opportunities, instead opting for less efficient strategies that expose assets to unnecessary taxation or risks.

By joining with RWA Wealth Partners, you gain guidance from professionals who are well-versed in trust strategies and who have the knowledge to provide customized solutions. Trusts are complex legal arrangements, and their successful use hinges on skilled expertise and careful planning. Without proper implementation, they can fail to achieve their goals and even create unintended tax consequences.

We can help thoughtfully design and incorporate trusts into your wealth management plan, providing you and your family with lasting security and confidence. Reach out to us today to identify gaps in your financial plan that would be well-served by a trust solution.

Sources:

1Lustbader, R. (n.d.). Caring.com’s 2024 wills survey finds that 40% of Americans don’t think they have enough assets to create a will. Caring.com.

2Marsano, J. (2022, June 20). What are Americans paying in probate? (Statistical analysis). Advanced Inheritance.

3Wolters Kluwer. (2020, October 2). Types of trusts: Revocable, irrevocable, living, and testamentary.

4Ericson, C. (2020, October 6). What to know about conditional gifts in a trust. Northwestern Mutual.

5Internal Revenue Service. (n.d.). Estate tax.

6Allcot, D. (2023, July 17). Generational wealth ‘curse’ is causing 90% of families to run out of money—How to beat the odds. Yahoo! Finance.

7Legal Information Institute. (2022, August). Charitable trusts purposes. Cornell Law School.

8Internal Revenue Service. (n.d.). Publication 526 (2022), charitable contributions.

9Internal Revenue Service. (n.d.). What’s new—Estate and gift tax.

10Wylie, M. (2023, November 7). Irrevocable life insurance trusts (ILIT). Moneygeek.

11Rosenbloom, A. S., Scharf, J. J., & Kiely, J. S. (2024, January 17). Prepare for soaring estate and gift tax exclusions and GST tax exemption to close after 2025. McDermott Will & Emery.

12Shipman & Goodwin LLP. (2023, January 10). 2023 estate, gift, and GST tax changes.

13Donovan, D. R., Abraham, B., & Koster, E. M. (2021, February 22). The 2020 election and the effect on current gift, estate and generation-skipping transfer taxes. Faegre Drinker.

14Dehan, A. J. (2023, June 28). These states allow domestic asset protection trusts. Yahoo! Finance.

15Internal Revenue Service. (n.d.). Section 7520 interest rates.

16Trieu, P. (2023, September 1). IRS signals it will challenge IDGT basis step-up at death. The Tax Adviser.

Disclosures:

For informational purposes only. Our statements and opinions are subject to change without notice. Data and statistics that may be contained in this report are obtained from what we believe to be reliable sources; however, their accuracy, completeness or reliability cannot be guaranteed.